- Arbitration

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Find out more

Real Estate & Construction and Hotels & Leisure

Real estate, construction, and hospitality are at the forefront of transformation across the Middle East – reshaping cities, driving investment, and demanding increasingly sophisticated legal frameworks.

In the June edition of Law Update, we take a closer look at the legal shifts influencing the sector – from Dubai’s new Real Estate Investment Funds Law and major reforms in Qatar, to Bahrain’s push toward digitalisation in property and timeshare regulation. We also explore practical issues around strata, zoning, joint ventures, and hotel management agreements that are critical to navigating today’s market.

As the landscape becomes more complex, understanding the legal dynamics behind these developments is key to making informed, strategic decisions.

2025 is set to be a game-changer for the MENA region, with legal and regulatory shifts from 2024 continuing to reshape its economic landscape. Saudi Arabia, the UAE, Egypt, Iraq, Qatar, and Bahrain are all implementing groundbreaking reforms in sustainable financing, investment laws, labor regulations, and dispute resolution. As the region positions itself for deeper global integration, businesses must adapt to a rapidly evolving legal environment.

Our Eyes on 2025 publication provides essential insights and practical guidance on the key legal updates shaping the year ahead—equipping you with the knowledge to stay ahead in this dynamic market.

The leading law firm in the Middle East & North Africa region.

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

-

Sectors

-

Country Groups

-

Client Solutions

Today's news and tomorrow's trends from around the region.

17 offices across the Middle East & North Africa.

Our Services

Back

Back

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

- Intellectual Property

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Projects

- Real Estate

- Regulatory

- Tax

- Turnaround, Restructuring & Insolvency

- Compliance, Investigations and White-Collar Crime

-

Sectors

-

Country Groups

-

Client Solutions

- Law Firm

- /

- Insights

- /

- Law Update

- /

- September 2020

- /

- The UAE Insurance Authority is now a fully fledged court

The UAE Insurance Authority is now a fully fledged court

Mona Allabban - Insurance

Introduction

Introduction

Following our article of September 2019 in which we discussed the amendments introduced to the processing of insurance claims in the UAE pursuant to the Federal Law No. 3 of 2018 amending certain provisions of Federal Law No. 6 of 2007 on the Establishment of Insurance Authority & Organization of Its Operations (’Amending Law’), as well as the Insurance Authority Board Resolution No. 33 of 2019 concerning the Regulation of the Committees Responsible for the Settlement and Resolution of Insurance Disputes (I’A Resolution No. 33’), the newly introduced dispute resolution committees at the Insurance Authority (’DR Committees’) became fully operational in end-2019.

As previously discussed, the Amending Law and the IA Resolution No. 33 provide that insurance-related claims falling under the jurisdiction of the DR Committees cannot be heard by local courts, unless such disputes have first been considered by the DR Committees.

Pursuant to the IA Board Resolution No. 34 of 2019 concerning the Appointment of the Members of the Insurance Dispute Resolution Committees ( ’IA Resolution No. 34’), which came into force in November 2019, two main committees were formed in Abu Dhabi and Dubai to resolve insurance claims that fall within the jurisdiction of the DR Committees and the said committees started to hear claims as of the end of 2019.

According to the IA Resolution No. 34, there is one main committee and one substitute committee appointed for each Emirate, for a one-year period. These committees consist of three members: a judge delegated by the Dubai/Abu Dhabi courts and two members from the Insurance Authority (IA).

New amendments to the jurisdiction of the DR Committees

On 12 March 2020, the IA issued Board Resolution No. 9 of 2020 (‘IA Resolution No. 9’) which introduced certain amendments to the IA Resolution No. 33. Those amendments mainly targeted the category of claims that fall under the jurisdiction of the DR Committees.

Initially, pursuant to Article 4 of the IA Resolution No. 33, the DR Committee(s) had jurisdiction to consider insurance disputes of all classes and types arising from complaints made by an insured, beneficiary or an affected person who has a right to bring a dispute against an insurance company licensed in the UAE.

While the IA Resolution No. 33 provided a wide definition for the ‘Beneficiary’ who may initiate a claim before the DR Committees, which included any assignee to whom the insurance benefits have been legally transferred, now pursuant to the IA Resolution No. 9, the said definition has been amended whereby it has been limited to the original beneficiary named under the policy. This amendment effectively excludes from the jurisdiction of the DR Committees, any claims from assignees against insurers. For example, in a scenario where a bank had, by way of security, obtained an assignment from the original beneficiary under the insurance policy and the insured risk occurred, the bank would not be entitled to resort to the DR Committees in case of any claim against the insurer. The bank should instead file its claim directly before the competent courts.

Further, Article 5 of the IA Resolution No. 33 (which sets out the types of actions and disputes that are beyond the jurisdiction of the DR Committees) has been amended pursuant to the IA Resolution No. 9 by introducing three additional types of actions that are excluded from the jurisdiction of the DR Committees’ jurisdiction. These are:

- subrogation claims of insurers against the third party who caused the damage;

- claims between insurance companies and the adjustment of balances; and

- claims between insurance-related professionals (such as Insurance brokers) and Insurance Companies.

Practical overview on the dispute resolution process before the DR Committee(s)

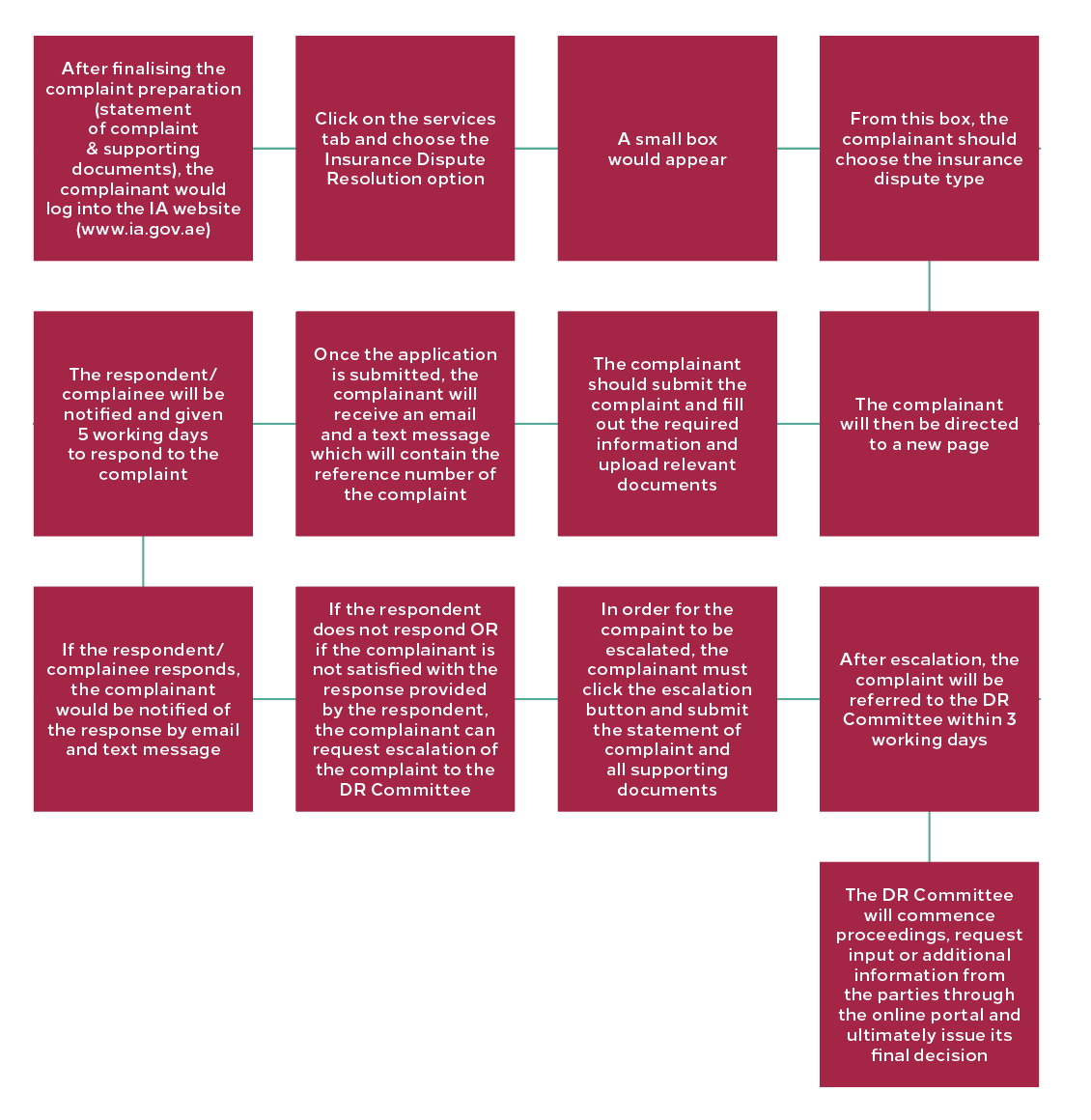

Since early 2020, Al Tamimi has acted on a number of complaints before the DR Committees. As noted in our previous article, the DR Committees have been granted extensive powers and authorities similar to those exercised by the local courts, such as hearing witnesses, appointing experts, and awarding costs. However, in practice and from our experience with the DR Committees so far, it appears that the claim process before IA and the DR Committees operates as follows:

It is to be noted that all complaints made to the IA should be registered exclusively through the IA’s online portal. The complainant may register the complaint by itself or via its legal representatives (currently there are no filing fees). Also, all exchanges and submissions are done exclusively through the IA portal where the complaint can be accessed by entering the registered mobile number and the one-time password provided by the IA via email and text message.

To date, and from the complaints we have acted on so far, we note that neither the IA nor the DR Committee has utilised the telecommunication technology stipulated by the IA Resolution No. 33. Further, the DR Committee has not so far appointed any experts in the complaints in which we were involved. So, practically speaking, the complaint processing appears to be limited to exchanging comments and submissions through the IA online portal without face to face or online interaction with the DR Committees.

Escalation to the DR Committee(s)

As noted in the above diagram, escalation of complaints to the DR Committees is not automatic. If the insurance company fails to respond to a complaint within the stipulated timeline or if the complainant is not satisfied by the insurance company’s response, the complainant must log in to the IA portal, push the escalation option button and upload the complaint and supporting documents in order to refer the complaint to the DR Committee.

Although the IA Resolution No. 33 does not require exhibits/supporting documents to be in Arabic, nonetheless, from practical experience, the IA will not escalate a complaint unless the exhibits/supporting documents are in Arabic or are duly translated to Arabic.

Once the complaint is escalated to the DR Committee, the DR Committee has 20 days to issue its judgment from the date it finalises its review of the statement of complaint and all relevant documents. This period may be extended by similar period(s) if the DR Committee deems it necessary.

Thus far, the Dispute Resolution process before the IA and DR Committee appears to be relatively fast and limited to exchanging a couple of submissions through the IA portal after which a decision can be expected within approximately one to three months from the date a complaint is filed on the IA’s portal.

Decisions handed down by the DR Committees

Al Tamimi had represented a local bank before the IA in a complaint filed in May 2020 against an insurance company. The complaint pertains to claim made under a comprehensive crime and professional indemnity insurance policy. The claim amount was approximately AED 22 Million (approximately US$6 million). The insurance company defended the claim on the premise that the claim falls under one of the policy exclusion clauses and that the insurer had ceded 100 per cent of the risk insured to reinsurers, who also rejected the claim on the ground that the claim falls under the exclusions of the reinsurance treaty.

In July 2020, the Dubai DR Committee issued its final decision, ordering the insurance company to pay the bank an indemnity amount of approximately AED 18.5 Million (approximately US$5 million) in addition to legal interest at the rate of nine per cent from the date the decision becomes final.

In another complaint, the Dubai DR Committee handed down a decision in a complaint made under a credit insurance policy whereby it decided to reject the complaint based on time prescription.

These decisions signify that the DR Committees are receptive to hearing not only the technical and substantive issues but also the strict legal challenges and pleas raised by the disputing parties.

As noted in our previous article, decisions issued by DR Committees may be challenged by the concerned party before the competent Court of First Instance within a period of 30 days from the following day on which the party was notified of the decision. If the decision is not challenged within the said time-frame, the decision will be considered final and enforceable.

Conclusion

The procedures and mechanism of the dispute resolution process has become a much more simplified process as the complaint is registered easily through the IA’s portal, and a decision is issued within a relatively short period of time. Issues such as the claim notification procedures, attending court hearings, and the high costs involved are not expected to be concerns of a complainant before the DR Committees.

Another advantage of the DR Committee is its composition of a judge and two members of the IA; this combines legal and technical expertise when considering insurance claims. Thus, we expect that insurance experts will not be relied on as often as before, which enables decisions to be issued quicker than before.

For further information, please contact Malek Zreiqat (m.zreiqat@tamimi.com) or Mona Allabban (m.allabban@tamimi.com).

Stay updated

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below.