- Arbitration

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Find out more

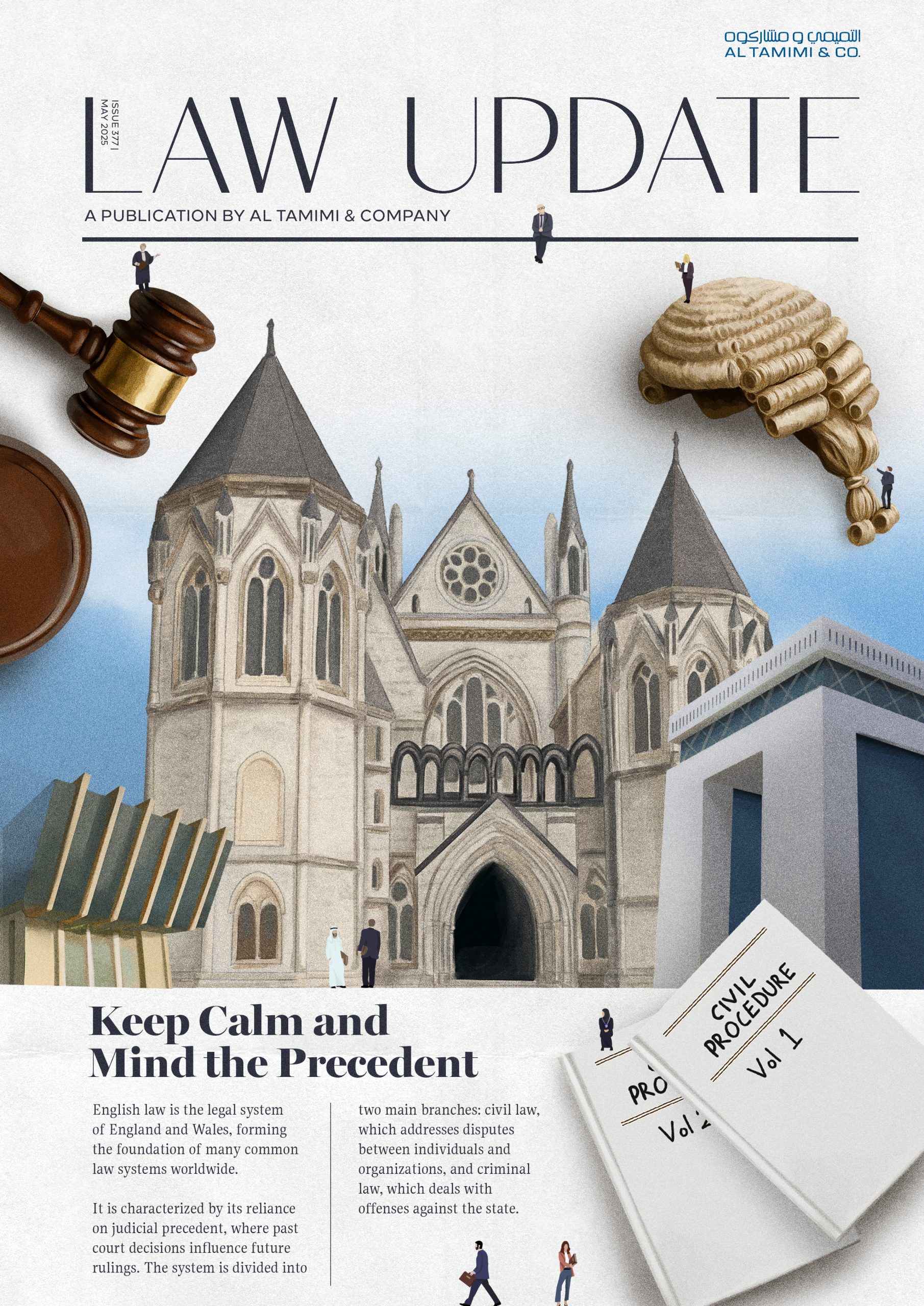

English Law: Keep calm and mind the precedent

In May Law Update’s edition, we examined the continued relevance of English law across MENA jurisdictions and why it remains a cornerstone of commercial transactions, dispute resolution, and cross-border deal structuring.

From the Dubai Court’s recognition of Without Prejudice communications to anti-sandbagging clauses, ESG, joint ventures, and the classification of warranties, our contributors explore how English legal concepts are being applied, interpreted, and adapted in a regional context.

With expert insight across sectors, including capital markets, corporate acquisitions, and estate planning, this issue underscores that familiarity with English law is no longer optional for businesses in MENA. It is essential.

2025 is set to be a game-changer for the MENA region, with legal and regulatory shifts from 2024 continuing to reshape its economic landscape. Saudi Arabia, the UAE, Egypt, Iraq, Qatar, and Bahrain are all implementing groundbreaking reforms in sustainable financing, investment laws, labor regulations, and dispute resolution. As the region positions itself for deeper global integration, businesses must adapt to a rapidly evolving legal environment.

Our Eyes on 2025 publication provides essential insights and practical guidance on the key legal updates shaping the year ahead—equipping you with the knowledge to stay ahead in this dynamic market.

The leading law firm in the Middle East & North Africa region.

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

-

Sectors

-

Country Groups

-

Client Solutions

Today's news and tomorrow's trends from around the region.

17 offices across the Middle East & North Africa.

Our Services

Back

Back

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

- Intellectual Property

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Projects

- Real Estate

- Regulatory

- Tax

- Turnaround, Restructuring & Insolvency

- Compliance, Investigations and White-Collar Crime

-

Sectors

-

Country Groups

-

Client Solutions

- Law Firm

- /

- Insights

- /

- Law Update

- /

- July 2020

- /

- New Insurance law in Kuwait: a brief overview

New Insurance law in Kuwait: a brief overview

Ahmed Rezeik - Senior Counsel, Head of Shipping - Kuwait (Consultant) - Arbitration / Litigation / Insurance / Shipping, Aviation & Logistics

In our previous article regarding branches of foreign insurance companies in Kuwait, we highlighted some of the expected updates in local laws, including the new Insurance Regulation Law No. 125 of 2019 ( ‘New Insurance Law’) which repealed the old law No. 24 of 1961.

In our previous article regarding branches of foreign insurance companies in Kuwait, we highlighted some of the expected updates in local laws, including the new Insurance Regulation Law No. 125 of 2019 ( ‘New Insurance Law’) which repealed the old law No. 24 of 1961.

We have been waited almost five years for this new law to be tabled. From the time it was tabled in September 2019, it faced several challenges for it to enter into force including: the resignation of the government of Kuwait; the problems of appointing the members of the Insurance Unit; and the lockdown imposed to curb the spread of the coronavirus, all of which led to the ongoing delay in the issuance of the Executive Regulations of the New Insurance Law required to define and clarify certain procedures and requirements found in the New Insurance Law. Now that the New Insurance Law is in force, we highlight some of its provisions below.

Under the New Insurance Law, the Insurance Department has been abolished and replaced it with a new insurance regulator known as the Insurance Regulatory Unit ( ‘IRU’). The IRU is an independent unit with a board consisting of a chairman, a deputy head and three part-time members appointed by a resolution of the Minister of Commerce and Industry ( ‘MOCI’) for a one time renewable period of four years, as well as a representative from the Central Bank of Kuwait and a representative from the MCI. Priority for appointments to the IRU board is given to individuals experienced in insurance, financial and relevant legal matters in Kuwait. The goals of the IRU board are to: (a) develop the IRU for the benefit of insurance companies and policyholders, by organising, regulating, controlling and developing the insurance business in a fair, transparent and competitive manner and developing its instruments in line with international best practices; (b) provide protection for those involved in insurance activity/business; (c) apply policies that achieve justice, ensure fairness and transparency and prevent conflicts of interests; (d) work to ensure compliance with laws and regulations related to insurance activities; and (e) educate the public about insurance activities, benefits, risks and the associated obligations thereof.

Although the IRU operates under the direct supervision of the MOCI, it is financially and administratively independent, and has an independent budget legal department. The IRU also has a special committee for complaints and grievances. This offers an insured entity the opportunity to ensure that the law is rightly applied in their circumstances.

The New Insurance Law also gives the IRU the right to control and inspect insurance companies to ensure the integrity of their financial and legal obligations and that such companies pledge to ensure that sufficient insurance coverage is provided to protect policyholders and beneficiaries.

The New Insurance Law also reduces the burden of insurance companies and policyholders. Insurance companies may now renew their licence every three years instead of annually. In addition, the New Insurance Law has given the policyholders the ability and the right to exercise a lien over the insurer’s property and the funds retained from the allocations in favour of policyholders in order to facilitate the execution of the judgments issued in their favour against the insurance companies.

However, the Executive Regulations that many of the provisions of the New Insurance Law refer to and rely on, still have not been issued at the time of writing. However, there remains uncertainty regarding which provisions of the New Insurance Law may be applied, including those regarding the conditions for granting licenses to branches of foreign insurance companies to operate in Kuwait, as well as the conditions, procedures and documents necessary for issuing or renewing the licence of insurance and reinsurance brokerage companies, and the conditions required to undertake risk assessment (and as adjusters), and qualify as insurance consultants and actuarial experts. It is hoped that the comprehensive and clear Executive Regulations will be issued in due course so that and legal enforcement and interpretation will not be performed arbitrarily.

The New Insurance Law also heightens some penalties imposed on insurance companies and those who violate the law, and these may include imprisonment and fine.

Finally, it must be noted that there is a one-year grace period to comply with the New Insurance Law from the date that the Executive Regulations are published. Accordingly, all insurance and reinsurance companies will have one year from the date of issuance of the Executive Regulations to make the necessary adjustments to ensure compliance with the New Insurance Law.

This article is intended to provide you with a brief overview on the New Insurance Law in Kuwait. In our next articles, we shall discuss the provisions of the Executive Regulations after additional articles have been issued.

For further information, please contact Ahmed Rezeik (a.rezeik@tamimi.com).

Stay updated

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below.