At the Heart of the Agenda: Qatar’s New Laws on Anti-Money Laundering and Counter Terrorism Financing

Ibtissem Lassoued - Partner, Co-head of Compliance, Investigations and White-Collar Crime - Compliance, Investigations and White-Collar Crime / Family Business

In the next phase of the seemingly inexorable march of Anti-Money Laundering and Counter-Terrorism (‘AML/CTF’) reform in the Middle East region, Qatar was due to face assessment by the Financial Action Task Force (‘FATF’) during the summer months concerning its controls against the illicit flow of funds. Replicating a pattern that has become the recognized approach for countries facing impending evaluation by the FATF, Qatar has concentrated its efforts over the past 18 months to introduce significant updates to its AML/CTF framework. In light of the monumental pressure that has rocked the global economy since the onset of the current health crisis, however, reform in this particular area in Qatar has been brought into a confluence of contextual factors that increase its importance, as the government attempts to balance the demands of cash flow in its economy against the need for stricter controls.

Adaptations provoked by the ongoing global health crisis, however, do not fall squarely on one side of the FATF assessment process. Whilst compliance functions grapple with new risks and vulnerabilities raised by altered working practices and alterations in macro flows of funds, FATF assessors are equally compelled to amend their evaluation methodology to accommodate the health and safety precautions required by all private business. The FATF has adjusted both its methodology and its timeline for on-site visits, meaning that Qatar will undergo the most substantive part of its examination via desk-research at a later date yet to be confirmed, with possible plenary discussion slated for June 2021; four months later than originally planned. In the grand scheme of AML/CTF evolution, four months can hardly be considered a sufficient length of time for a country to implement substantial change to its AML/CTF system.

But, in the context of Qatar’s recent efforts to overhaul its legislative framework, the delay may provide critical time for the authorities to improve the effectiveness of new systems and protocols; a key metric of assessment under the FATF methodology.

Changing the Anatomy of the System

Judging by the extent of the legislative reforms that have been introduced, Qatar is evidently keen to show that it has taken the necessary steps to address the deficiencies in its AML/CTF framework identified by the FATF in its previous Mutual Evaluation Report (‘MER’), published in 2008.

Law No. 20 of 2019 Promulgating Law of Anti-Money Laundering and Combating the Financing of Terrorism (‘AML Law’) came into effect in September 2019 as the first standalone update to Qatar’s AML/CTF framework in almost 10 years, replacing Law No. 4 of 2010, with a central focus on implementing international best practice. Many of the provisions within the AML Law (and the Executive Regulations issued by Cabinet Resolution No. 41 of 2019) have been intentionally drafted to adopt identical language and structure of provisions used in the FATF 40 Recommendations to ensure that the full extent of the FATF standards are reflected within domestic legislation. From a high level, the new provisions are orientated towards providing broadened scope and stronger powers for the authorities to prosecute money laundering and terrorist financing offences, introducing stronger sanctions for deterrence, widening the extent of criminalised activity and enhancing the ability of the authorities to co-operate with international counterparts in cross-border efforts.

Whilst the modernisation of its legislation is an important development for Qatar, many of the provisions replicate measures that have already been implemented in other countries at a more advanced stage in enshrining AML/CTF protections into law. The risk based approach that is required for Financial Institutions (‘FI’) and Designated Non-Financial Businesses and Professions (‘DNFBPs’) is a landmark feature of contemporary AML/CTF best practice, and other requirements such as the maintenance of records for financial intelligence purposes has also become par for the course in many more developed systems. The replicative outline of the provisions is an inevitable consequence of closer adherence to the FATF’s 40 Recommendations, as countries across the world attempt to align their systems with the prescribed practices as closely as possible. Whilst the skeleton of the laws may be somewhat genericised, however, requirements such as those that refer to the National Risk Assessment simultaneously maintain a broad awareness and better management of Qatar’s specific money laundering and terrorism financing risks amongst key stakeholders.

Counter-Terrorism Financing and Sanctions

Some of the most significant changes have been brought about by Law No 27 of 2019 on the Issuance of the Counter-Terrorism Law (‘Counter-Terrorism Law’), which goes a long way to strengthening Qatar’s focus on internal and external threats from terrorist organisations. Under the new law, Qatar has established a new National Counter-Terrorism Committee, tasked with co-ordinating the efforts of all relevant stakeholders responsible for implementing defences against terrorist activity. This is a new centralised approach, involving active participation in international delegations, preparing and supervising a national strategy for combating terrorism and raising public awareness of the risks related to terrorism.

The Counter Terrorism Law also encapsulates Qatar’s revised framework for imposing targeted financial sanctions. Whilst Qatar has been a member of the UN since 1971 and its obligation to implement United Nations (‘UN’) sanctions is not novel, the level of transparency and accessibility around a comprehensive sanctions framework has been a key deficiency. Under previous legislation, Qatar was criticised by the FATF for having an incomplete framework, which lacked provisions for designating terrorists, or freezing funds under specific UN Security Council Resolutions. Supplementary legislation has also been brought in to support Qatar’s efforts to improve transparency by imposing additional reporting and disclosure requirements and record keeping for financial intelligence purposes.

Arterial Legislation

The authorities have taken an holistic approach to legislative evolution, introducing not only new flagship legislation but also a tranche of supporting regulations that disseminate the impact of the new AML/CTF laws throughout the financial system. Effectively creating a trickle-down effect, supervisory bodies in Qatar have issued various decisions imposing direct obligations on regulated entities and clarifying the procedures and responsibilities of the supervisory bodies themselves in order to reinforce the requirements of the AML Law and Counter-Terrorism Law.

By way of example, the Board of Directors of the Qatar Financial Markets Authority (‘QFMA’) has issued the new Anti-Money Laundering and Counter-Terrorism Financing Rules which entered into force in February 2020 and are applicable to all financial markets, listed companies and funds, and private business supervised and/or licensed by the QFMA. Whilst the rules largely echo the requirements of the AML Law, they also offer additional regulations and guidance on specific AML/CTF compliance aspects to enable subject companies to form and maintain robust control programmes that are reflective of best practice. The role of the QFMA in mandating high standards of

AML/CTF compliance is especially important given its overall objective of attracting foreign investment to the country and protecting the interests of investors.

Likewise, the Qatari Public Prosecution also issued Decision no. 1 of 2020 (‘Decision’), relating to the implementation of a mechanism for targeted financial sanctions against terrorism financing and proliferation financing, under the provision of the Counter Terrorism Law. The procedures outlined in the Decision scope out a clear role for the Public Prosecution to designate individuals and entities pursuant to UN Security Council Resolutions or on the recommendation of the National Counter Terrorism Committee or relevant foreign authority. This legislative reinforcement is designed to introduce more transparency and efficiency to the sanctions framework and, particularly in the case of its domestic sanctions list, will grant more autonomy to the Qatar government to implement its own restrictions within its system, co-operate with foreign counterparts, and also the provide an effective remedy for legal or natural persons that wish to challenge their listed status.

In other jurisdictions, the role of overseeing sanctions designations lists is commonly carried out by other authorities, such as those concerned with import and export matters. By installing the Public Prosecution at the centre of efforts to enforce counter-terrorism provisions and sanctions, however, Qatar has created a mechanism that may prove to be more responsive when it comes to criminal matters involving the enforcement of targeted sanctions which, in turn, has the potential to act as an effective deterrent for criminal or terrorist actors seeking to abuse Qatar’s financial system.

Beyond the implementing measures of the AML Law and Counter Terrorism Law, Qatar has sought to introduce reinforcing legislation in ancillary parts of its legal framework. For example, the Cabinet recently issued Resolution No. 18 of 2020, introducing a Code of Conduct and Integrity Charter for Public Officials (‘Charter’) in order to increase efficiency and transparency of state functions, which are responsible for a considerable proportion of funds that flow through the Qatari commercial and financial sectors. The Charter codifies some of the commitments made by Qatar as a ratifying member of the United National Convention Against Corruption and, whilst it does not directly relate to AML/CTF controls, is fundamental to preserving the underlying integrity in governance that it critical to maintaining a stable AML/CTF framework.

Maladies in Implementation

Whilst piecemeal changes constitute relatively minor revisions in isolated contexts, the combined impact of modifications is a more robust level of defence against financial crime and can represent an opportunity for authorities to capitalise on a more sophisticated capacity to detect and prevent the illicit flow of funds.

The process of bringing legislation in line with international best practice is not unique to Qatar; all countries that have undergone FATF assessment have emulated this pattern of transformation to varying degrees. Previous examples of countries attempting to maximise their evaluations have given rise to several trends that we can expect to see over the coming months on the periphery of the FATF assessments in the Middle East. One of the most fundamental elements of an effective framework is the ability of the authorities to raise awareness around the specific threats related to money laundering and terrorism financing, and the way in which emerging trends interact with these risks. Considering that Qatar’s new laws are in their relative infancy, it is likely that there will be a degree of disparity between Qatar’s current levels of technical compliance with AML/CTF standards and its effectiveness score (which is the score the FATF awards based on its practical immediate outcomes). Closing this gap will likely be a key priority for the Qatari authorities over the coming months before the start of the assessment. Qatar does not stand alone in facing this issue, however. As mentioned, other countries that have recently undergone their Mutual Evaluation assessment also show the signs of Governments needing to bring practical transformation up to speed with the pace of legislative reform, as authorities race towards best practice and their long-term strategic visions.

Keeping a Steady Rate – Next steps for Qatar’s AML/CTF

Irrespective of the FATF assessment, effective implementation of Qatar’s new laws will require a stringent and proactive approach by the Qatari authorities in order to provide the intended protection for the national economy. Inevitably with such extensive alterations to practices that permeate so many life systems of the state – the private sector, the financial system, law enforcement, supervisory bodies and the judiciary – there is a period of adjustment, as operations are perfected and efficiencies are created. But as stronger controls osmose into the everyday functioning of Qatar’s system at the cellular level, these changes will provide the authorities with the necessary tools to maintain a much tighter grip on the flow of funds that rush through the national financial infrastructure.

It is not enough for the Qatari authorities to punctuate their AML response with brief spells of attention and activity, treating the FATF assessment as a curlicue to round off their efforts of the past 18 months with a flourish. The authorities will need to ensure their finger is kept on the pulse and their efforts are sustained at a steady rate for the remainder of the revised FATF assessment period and beyond, if they are to be successful in their efforts to protect the health of the financial system.

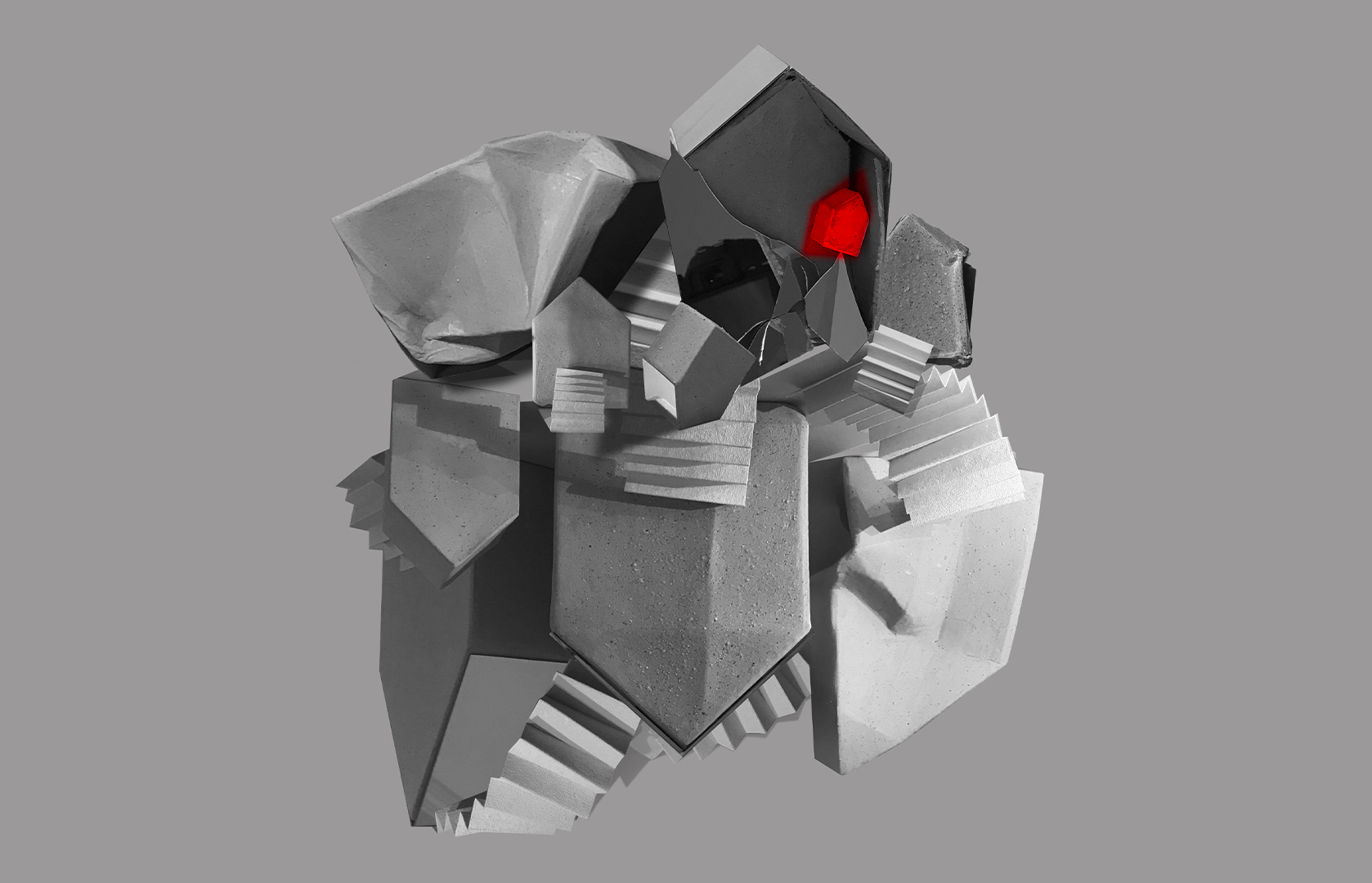

The Weight of War 1st. Narration (from THEM series)

Photo-Sculpture

Cardboard, Ceramic Clay, RGB Lights and Mirror

Curated by Rebia Naim @EmergingScene

Stay updated

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below.