- Arbitration

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Find out more

Real Estate & Construction and Hotels & Leisure

Real estate, construction, and hospitality are at the forefront of transformation across the Middle East – reshaping cities, driving investment, and demanding increasingly sophisticated legal frameworks.

In the June edition of Law Update, we take a closer look at the legal shifts influencing the sector – from Dubai’s new Real Estate Investment Funds Law and major reforms in Qatar, to Bahrain’s push toward digitalisation in property and timeshare regulation. We also explore practical issues around strata, zoning, joint ventures, and hotel management agreements that are critical to navigating today’s market.

As the landscape becomes more complex, understanding the legal dynamics behind these developments is key to making informed, strategic decisions.

2025 is set to be a game-changer for the MENA region, with legal and regulatory shifts from 2024 continuing to reshape its economic landscape. Saudi Arabia, the UAE, Egypt, Iraq, Qatar, and Bahrain are all implementing groundbreaking reforms in sustainable financing, investment laws, labor regulations, and dispute resolution. As the region positions itself for deeper global integration, businesses must adapt to a rapidly evolving legal environment.

Our Eyes on 2025 publication provides essential insights and practical guidance on the key legal updates shaping the year ahead—equipping you with the knowledge to stay ahead in this dynamic market.

The leading law firm in the Middle East & North Africa region.

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

-

Sectors

-

Country Groups

-

Client Solutions

Today's news and tomorrow's trends from around the region.

17 offices across the Middle East & North Africa.

Our Services

Back

Back

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

- Intellectual Property

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Projects

- Real Estate

- Regulatory

- Tax

- Turnaround, Restructuring & Insolvency

- Compliance, Investigations and White-Collar Crime

-

Sectors

-

Country Groups

-

Client Solutions

- Law Firm

- /

- Insights

- /

- Law Update

- /

- September 2018

- /

- A New Schedule of Fees for Real Estate in Abu Dhabi

A New Schedule of Fees for Real Estate in Abu Dhabi

David Bowman - Senior Counsel - Real Estate

The Chairman of Abu Dhabi Executive Council has issued Resolution No. 49 of 2018 on the Municipal Services Fees in the Emirate of Abu Dhabi (“Resolution No. 49) which came into effect on 27 May 2018. Resolution No. 49 introduces a new schedule of fees applicable to real estate disposals and the ownership of real estate in the Emirate of Abu Dhabi.

- Resolution No. 49 entirely abolishes and replaces the following earlier laws and resolutions:

- Abu Dhabi Executive Council Chairman Resolution No. 43 of 2018 on Municipal Services Fees in the Emirate of Abu Dhabi;

- Abu Dhabi Executive Council Chairman Resolution No. 14 of 2016 on the Rent or Musataha Fee for Industrial Lands and Plots Leased from the Government in the Emirate of Abu Dhabi;

- Abu Dhabi Executive Council Chairman Resolution No. 13 of 2016 amending some provisions of Resolution No. 4 of 2011 concerning the Rules and Procedures of Registration of Lease Contracts in the Emirate of Abu Dhabi;

- Abu Dhabi Executive Council Chairman Resolution No. 72 of 2015 on Real Estate Registration Fees and Exemption therefrom in the Emirate of Abu Dhabi; and

- any other provisions which contradict or are inconsistent with Resolution No. 49.

All fees stated in Resolution No. 49 are payable to Abu Dhabi City Municipality, Al Ain City Municipality and Al Dhafra Region Municipality (“Municipalities”), as applicable depending on the location of the property.

Implementing Resolutions to be Issued by the Executive Committee

The implementation of a number of fees referred to in Resolution 49, including the new sale and purchase registration fees and the “white land tax”, remain subject to the issuance of implementing resolutions by the Executive Committee. To date, the Executive Committee has not yet issued any of the implementing resolutions required under Resolution No. 49.

The Executive Committee was established by Abu Dhabi Executive Council Chairman Resolution No. 53 of 2006 and is composed of the following members:

- Chairman of Abu Dhabi Executive Office

- Chairman of the Department of Transport

- Chairman of the Department of Community Development

- Commander-in-Chief of Abu Dhabi Police

- Chairman of Department of Health

- Chairman of the Department of Education and Knowledge

- Chairman of Department of Energy

- Chairman of Department of Economic Development

- Chairman of the Department of Urban Planning and Municipalities

- Chairman of the Department of Culture and Tourism

Sale and Purchase Registration Fees

Resolution No. 49 provides that the fees for the registration of sales and purchases will be determined by the Executive Committee. Fees for the registration of sales and purchasers shall be at least 1% and not more than 4% of the transaction value, or if higher the property value as assessed by the relevant Municipality. Fees shall be borne between the seller and purchaser equally, unless agreed otherwise.

The Executive Committee has not yet issued its resolution determining the sale and purchase registration fees and until such time, the Municipalities will continue to apply a rate of 2% of the property value (or if higher the property value as assessed by the relevant Municipality), without any upper fee cap, upon the registration of a sale and purchase transaction.

Musataha and Usufruct Registration Fees

The fees for the registration of musataha and usufruct rights are now set at the rate 4% of the value of the musataha or the usufruct rights.

The musataha/usufruct registration fees as set by Resolution No. 49:

- are not subject to any cap;

- are calculated as follows: 4% of the annual musataha or usufruct consideration (which should be a figure close to the market value as at the date of registration) multiplied by the number of years of the musataha or usufruct term stated in the agreement; and

- are payable to the relevant Municipality upfront on the date of registration of the musataha or usufruct agreement.

Disposal of Granted Land

Resolution No. 49 has lifted the prohibition on the disposal of granted commercial and investment land in the Emirate of Abu Dhabi, subject to the payment of 15% of the land value to the Relevant Municipality if the granted commercial or investment land is bare land at the time of disposal.

For the purposes of payment of these fees, disposal includes sale, gift and public auction sale but excludes the mortgaging of the land. In this respect, where a lender intends to mortgage bare land which has granted to the owner, it will need to factor in the possible fees payable by the lender or a future buyer should the mortgage be enforced and land sold at auction.

“White Land Tax”

“White Land Tax”

An annual fee will be imposed and collected by the Municipalities on a selected list of vacant commercial and investment land (but expressly excluding residential land). If the vacant commercial or investment land benefits from infrastructure services, the annual fee will be levied at a rate of between 1% and 4% of the land value. The Executive Committee will issue a further resolution to determine which vacant commercial and investment land will be subject to these annual fees. This further resolution will specify the locations and criteria for the vacant land which will be made subject to the “white land tax”. It will also set the applicable rate of annual fee payable in each case.

A similar tax was introduced last year in the Kingdom of Saudi Arabia on undeveloped land with the aim to resolve the gap between the supply and demand forces in the Saudi real estate market in specific urban areas.

It remains to be seen how the “white land tax” will apply and be implemented in Abu Dhabi. We do not yet know how the Executive Committee will decide which land to include and the different level of fees which will be applied. We also wait to see what does the requirement for “infrastructure services to be available” means in practice for the purposes of applying “white land tax”.

Infrastructure Fee

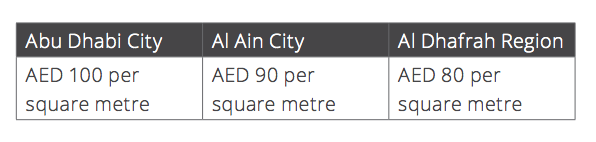

With effect from 27 May 2018, a one-off infrastructure fee will be payable to the relevant Municipality on all commercial and investment land. When applying the “infrastructure fee”, the relevant Municipality will refer to the permitted use of the land as mentioned the land site plan issued by such Municipality. The infrastructure fees will be calculated based on the land Gross Floor Area (GFA) at the following rates:

Other Fees

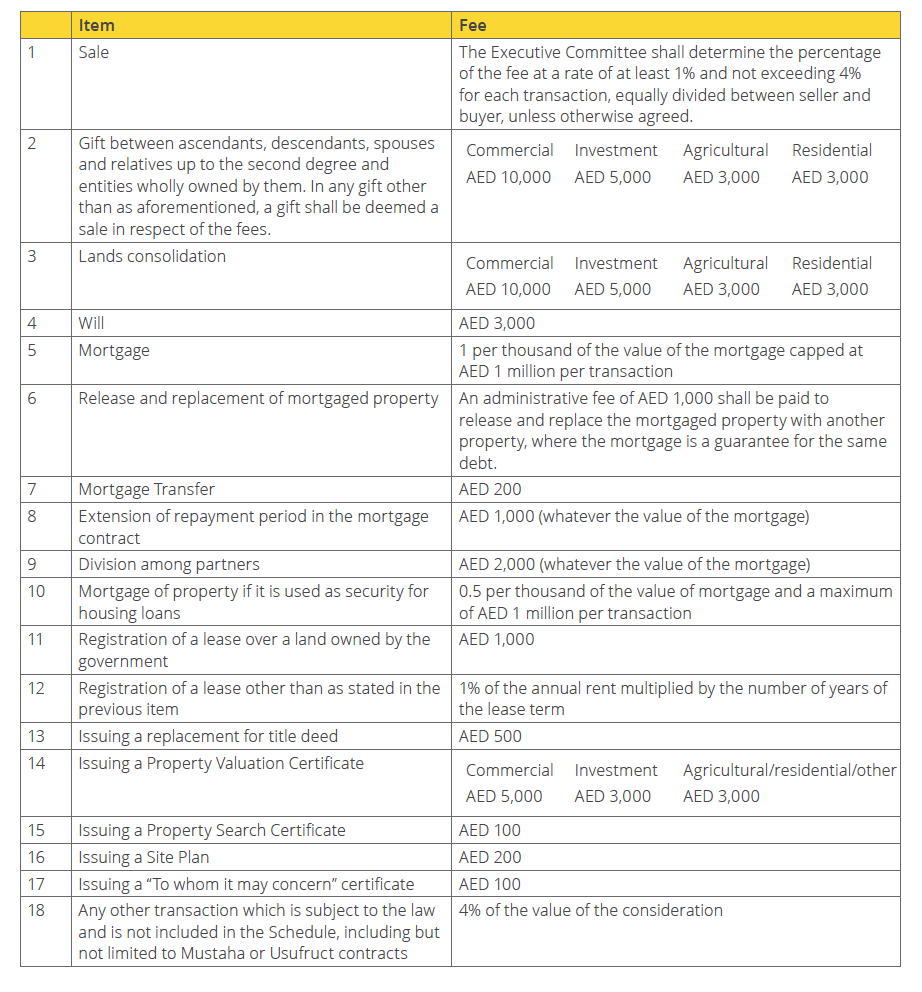

We outline below a schedule of the fees applicable to real estate transactions and services, land area increases, planning services and lease registration services as set by Resolution No. 49:

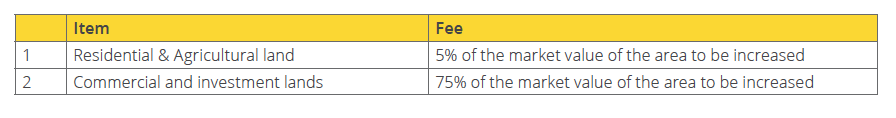

Fees for increasing the land area

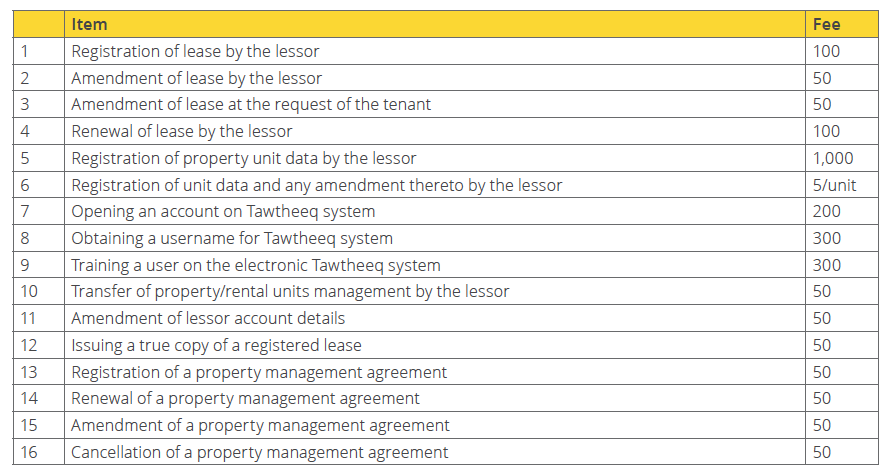

Lease Registration Fees

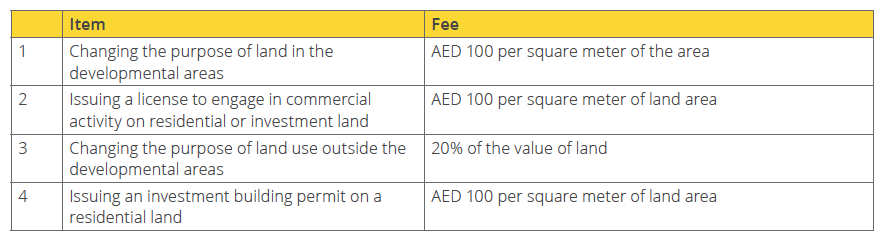

Planning Services Fees

Al Tamimi & Company’s real estate team in Abu Dhabi regularly advises on real estate transactions and the latest legal developments relating to the real estate market in the Emirate of Abu Dhabi. For further information, please contact Maha Dahoui (m.dahoui@tamimi.com) or David Bowman (d.bowman@tamimi.com).

Stay updated

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below.