- Arbitration

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Find out more

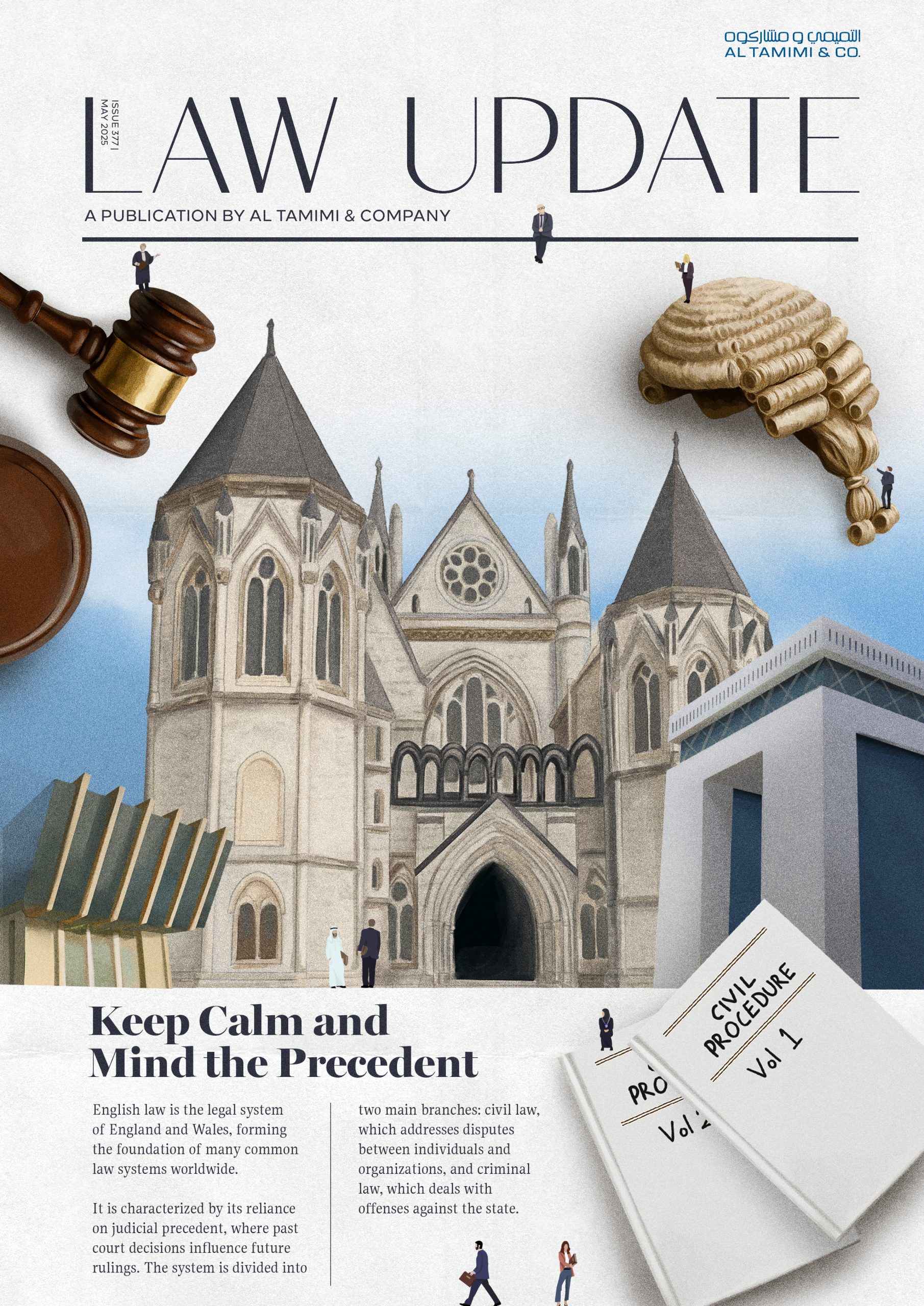

English Law: Keep calm and mind the precedent

In May Law Update’s edition, we examined the continued relevance of English law across MENA jurisdictions and why it remains a cornerstone of commercial transactions, dispute resolution, and cross-border deal structuring.

From the Dubai Court’s recognition of Without Prejudice communications to anti-sandbagging clauses, ESG, joint ventures, and the classification of warranties, our contributors explore how English legal concepts are being applied, interpreted, and adapted in a regional context.

With expert insight across sectors, including capital markets, corporate acquisitions, and estate planning, this issue underscores that familiarity with English law is no longer optional for businesses in MENA. It is essential.

2025 is set to be a game-changer for the MENA region, with legal and regulatory shifts from 2024 continuing to reshape its economic landscape. Saudi Arabia, the UAE, Egypt, Iraq, Qatar, and Bahrain are all implementing groundbreaking reforms in sustainable financing, investment laws, labor regulations, and dispute resolution. As the region positions itself for deeper global integration, businesses must adapt to a rapidly evolving legal environment.

Our Eyes on 2025 publication provides essential insights and practical guidance on the key legal updates shaping the year ahead—equipping you with the knowledge to stay ahead in this dynamic market.

The leading law firm in the Middle East & North Africa region.

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

-

Sectors

-

Country Groups

-

Client Solutions

Today's news and tomorrow's trends from around the region.

17 offices across the Middle East & North Africa.

Our Services

Back

Back

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

- Intellectual Property

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Projects

- Real Estate

- Regulatory

- Tax

- Turnaround, Restructuring & Insolvency

- Compliance, Investigations and White-Collar Crime

-

Sectors

-

Country Groups

-

Client Solutions

Dubai Court reassures its settled practice on Compound Interest and Adequate Security

On 2 January 2023, Federal Decree law no. 23 of 2022 (the “Amended Central Bank Law”) came into force and introduced, inter alia:

a) An amendment to Article 121.4 of the Central Bank Law (“CBL”), under which Licensed Financial Institutions shall not charge interest on accrued interest i.e., compound interest; and

b) Article 121(bis) which provides that Licensed Financial Institutions must obtain adequate security for facilities extended to natural clients and private sole proprietorships, otherwise the bank’s claim(s) arising out of this credit facility will be inadmissible.

Compounded Interest

Since the effective date of the Amended Central Bank Law, legal practitioners in the banking sector were eager to hear the word of the Dubai Court of Cassation.

On 12 September 2023, the Dubai Court of Cassation issued a judgment deciding, and maintaining its position, that “interests shall be calculated as per the agreed rate on a compound basis until the account is closed unless agreed otherwise to be calculated on a simple basis”.

The Dubai Court of Cassation did not however address nor interpret Article 121.4 of the CBL in that context.

Adequate Security

Circular no. 9 of 2022 and its explanatory circular no. 3 of 2023 (the “Circulars”) were issued by the Judicial Department in the Emirate of Abu Dhabi to give effect to the Article 121(bis) of the Federal Decree and expand its application by:

a) Granting the Amendment Central Bank Law retrospective application.

b) Applying the Amendment Central Bank Law to all customer segments including corporate lending; and

c) Considering personal guarantees as inadequate security in the meaning of Article 121(bis) of the CBL.

The Abu Dhabi Court of Cassation rendered several judgments where it gave full effect to the Circulars.

Despite the position adopted in Abu Dhabi, Dubai Courts have taken a different approach on the adequate security topic, as follows:

- On 17 August 2023, the Dubai Court of Cassation issued an order deciding that Article 121(bis) shall not apply retrospectively and accordingly declined a request to apply Article 121(bis) to a credit facility that was executed on 1 October 2017.

- On 29 August 2023, the Dubai Court of Cassation ruled that the Circulars shall only concern Abu Dhabi Courts, but not the Dubai Courts which stand, among other judicial entities in the UAE, as a separate judiciary from both the federal judiciary and the local judiciary of the Emirate of Abu Dubai. As such, the Dubai Court of Cassation did not apply the Circulars to the proceedings before it.

It follows that, the Dubai Court of Cassation, unlike the position in Abu Dhabi Courts, narrowly interprets Article 121(bis) and generally maintains its settled legal principles concerning banking litigation.

How can we help?

If you are having any queries related to the Amended Central Bank Law and Circulars and their implications, please feel free to contact the key contacts.

Key Contacts

Stay updated

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below.