- Arbitration

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Find out more

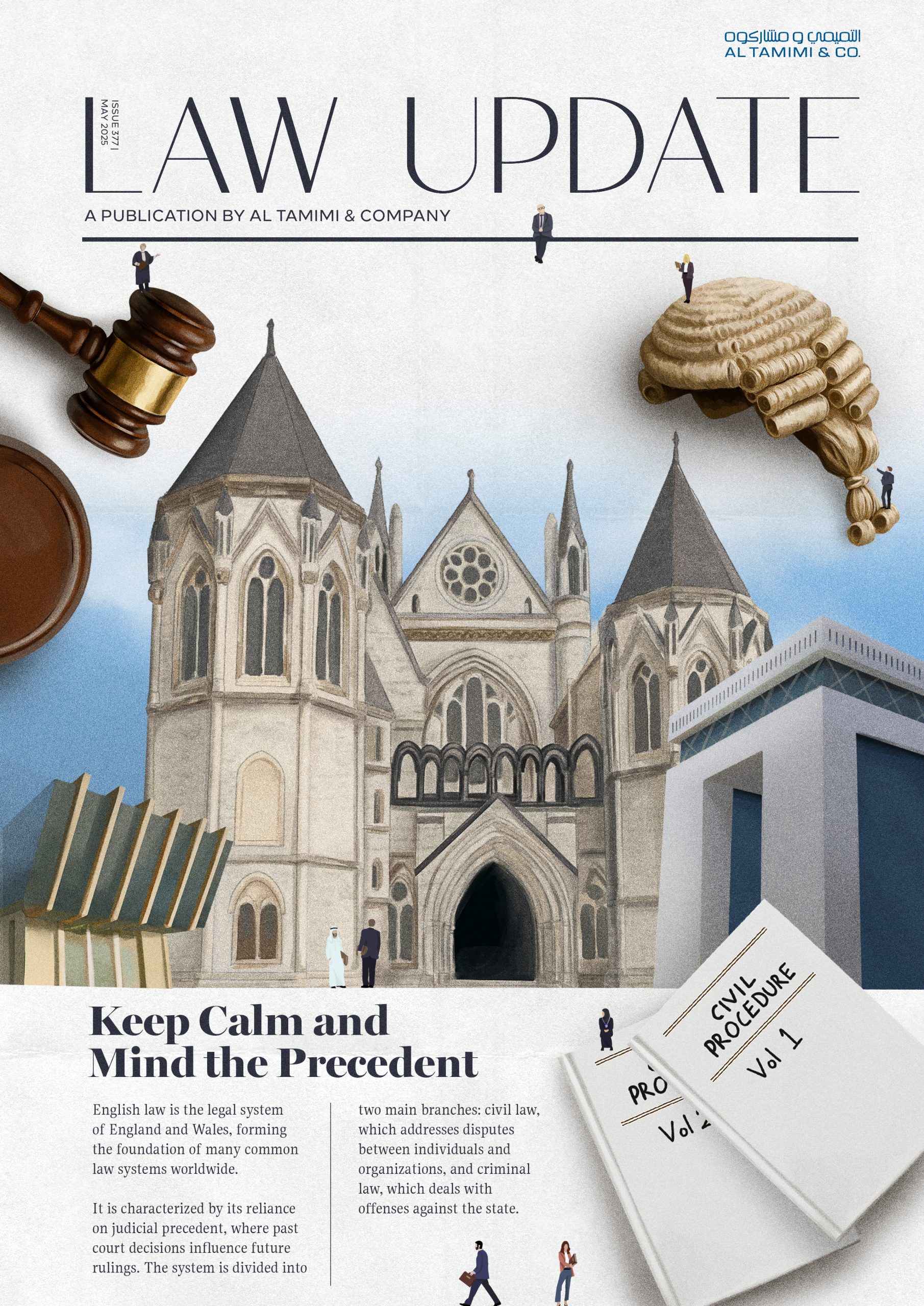

English Law: Keep calm and mind the precedent

In May Law Update’s edition, we examined the continued relevance of English law across MENA jurisdictions and why it remains a cornerstone of commercial transactions, dispute resolution, and cross-border deal structuring.

From the Dubai Court’s recognition of Without Prejudice communications to anti-sandbagging clauses, ESG, joint ventures, and the classification of warranties, our contributors explore how English legal concepts are being applied, interpreted, and adapted in a regional context.

With expert insight across sectors, including capital markets, corporate acquisitions, and estate planning, this issue underscores that familiarity with English law is no longer optional for businesses in MENA. It is essential.

2025 is set to be a game-changer for the MENA region, with legal and regulatory shifts from 2024 continuing to reshape its economic landscape. Saudi Arabia, the UAE, Egypt, Iraq, Qatar, and Bahrain are all implementing groundbreaking reforms in sustainable financing, investment laws, labor regulations, and dispute resolution. As the region positions itself for deeper global integration, businesses must adapt to a rapidly evolving legal environment.

Our Eyes on 2025 publication provides essential insights and practical guidance on the key legal updates shaping the year ahead—equipping you with the knowledge to stay ahead in this dynamic market.

The leading law firm in the Middle East & North Africa region.

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

-

Sectors

-

Country Groups

-

Client Solutions

Today's news and tomorrow's trends from around the region.

17 offices across the Middle East & North Africa.

Our Services

Back

Back

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

- Intellectual Property

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Projects

- Real Estate

- Regulatory

- Tax

- Turnaround, Restructuring & Insolvency

- Compliance, Investigations and White-Collar Crime

-

Sectors

-

Country Groups

-

Client Solutions

DIFC Introduces Enhanced Insolvency Regime

The DIFC has enacted the DIFC Insolvency Law 2019 which repeals and replaces the Insolvency Law 2009. Together with the expanded and restated Insolvency Regulations 2019, the new insolvency regime will take full effect on 13 June 2019.

The law applies in the jurisdiction of the DIFC, which means that it applies to all DIFC incorporated companies and to all DIFC limited liability partnerships. It restates with certain modifications the existing provisions relating to voluntary arrangements, to receivership and to winding up whilst at the same time, in line with best international practice, introducing important new ‘rehabilitation’ and ‘administration’ insolvency mechanisms.

More specifically the new law introduces a debtor in possession rehabilitation procedure supervised by the court. During the rehabilitation process, an insolvent company is protected against its creditors and any insolvency steps against it during a 120 day moratorium period, and can emerge at the end of the moratorium, if possible, with a court approved arrangement with creditors (rehabilitation plan).

In addition, the 2019 law introduces a new administration process which can be triggered where the conditions for rehabilitation exist and there is, additionally, evidence of mismanagement or misconduct. In such cases creditors may apply for the appointment of an administrator who will manage the business and assets of the company for the 120 moratorium or such other period as directed, during which the company is similarly protected against its creditors. At the end of the period, the court may approve a rehabilitation plan or a voluntary arrangement with creditors or other specific scheme of arrangement. As part of the administration process the court may also order the investigation of potential fraud or other defined wrongdoing including suspected transactions at an undervalue or unlawful preferences.

Other changes introduced by the new law include enhancements to voluntary and compulsory winding up procedures; additional provisions governing wrongful trading and the re-use of company names; the creation of an offence of misconduct in the course of winding up; the incorporation into DIFC law of the UNCITRAL Model Law on cross border insolvency proceedings (with certain modifications for application in the DIFC); and additional provisions relating to the enforcement of financial collateral.

The new DIFC insolvency regime represents an important step in the evolution of protective and remedial mechanisms available to clients who may be impacted by insolvency in the DIFC, whether as creditors or debtors, and by wider debtor/creditor and insolvency issues in the UAE and further afield.

Key Contacts:

Rita Jaballah

Partner, Head of

DIFC Litigation

r.jaballah@tamimi.com

Patrick Dillon-Malone

Senior Associate,

Litigation

p.malone@tamimi.com

Peter Smith

Senior Associate,

Litigation

p.smith@tamimi.com

Stay updated

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below.