- Arbitration

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Find out more

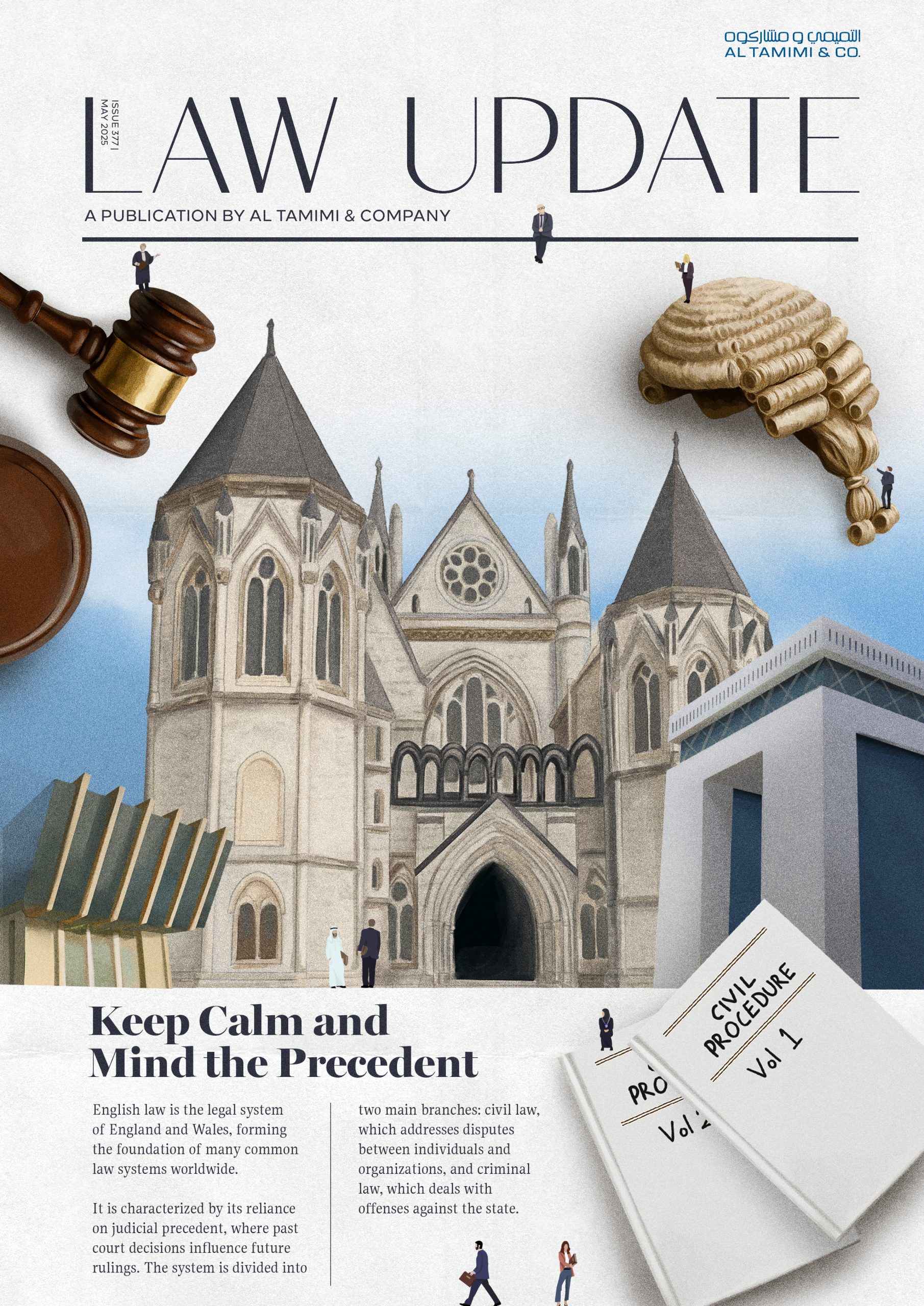

English Law: Keep calm and mind the precedent

In May Law Update’s edition, we examined the continued relevance of English law across MENA jurisdictions and why it remains a cornerstone of commercial transactions, dispute resolution, and cross-border deal structuring.

From the Dubai Court’s recognition of Without Prejudice communications to anti-sandbagging clauses, ESG, joint ventures, and the classification of warranties, our contributors explore how English legal concepts are being applied, interpreted, and adapted in a regional context.

With expert insight across sectors, including capital markets, corporate acquisitions, and estate planning, this issue underscores that familiarity with English law is no longer optional for businesses in MENA. It is essential.

2025 is set to be a game-changer for the MENA region, with legal and regulatory shifts from 2024 continuing to reshape its economic landscape. Saudi Arabia, the UAE, Egypt, Iraq, Qatar, and Bahrain are all implementing groundbreaking reforms in sustainable financing, investment laws, labor regulations, and dispute resolution. As the region positions itself for deeper global integration, businesses must adapt to a rapidly evolving legal environment.

Our Eyes on 2025 publication provides essential insights and practical guidance on the key legal updates shaping the year ahead—equipping you with the knowledge to stay ahead in this dynamic market.

The leading law firm in the Middle East & North Africa region.

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

-

Sectors

-

Country Groups

-

Client Solutions

Today's news and tomorrow's trends from around the region.

17 offices across the Middle East & North Africa.

Our Services

Back

Back

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

- Intellectual Property

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Projects

- Real Estate

- Regulatory

- Tax

- Turnaround, Restructuring & Insolvency

- Compliance, Investigations and White-Collar Crime

-

Sectors

-

Country Groups

-

Client Solutions

Coronavirus Considerations: Banking and cashflow

A consequence of the Coronavirus situation is the immediate financial impact on businesses caused by things such as contracts not being fulfilled, reduced customer footfall and increased costs due to having to find alternative suppliers. Many businesses will find their cashflows stressed for reasons completely outside of their control. Even if a force majeure can be proved (see above) and a business has a strong contractual right to claim for damages, businesses will need to ensure that they take steps to ensure they are around long enough to bring a claim.

Along with the other steps that can be taken as mentioned in this note such as reviewing credit and other insurance policies, we would recommend the following:

- Speak to your lenders. If you have finance in place and there is a risk that any of your financing terms could be breached, contact your lender(s) to discuss. You are far better served by entering into dialogue with your lenders to explain the situation and request some flexibility. Lenders do not like to be told of issues at the last moment and be forced into making decisions

- Manage your cashflows. Review all expenditure and critically assess all planned costs and identify any savings that can be made, deferring expenditure if possible

- Review your supply chain early to determine if supplies are likely to be affected and if so try to source alternative suppliers

- Review agreements with customers to establish liability if you cannot meet your obligations. If this could happen, speak to your customers early and seek to extend delivery terms.

It is inevitable that some businesses will face severe financial difficulties, even insolvency, as a result of Coronavirus. Every business needs to be aware of the impact on its business and to the extent that external funding is involved, it always pays to involve your lenders as early as possible to give them as long as possible to consider anything they can do to support you.

Key Contact

Matthew Heaton

Head of Office – Qatar, Banking & Finance

m.heaton@tamimi.com

Stay updated

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below.