- Arbitration

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Find out more

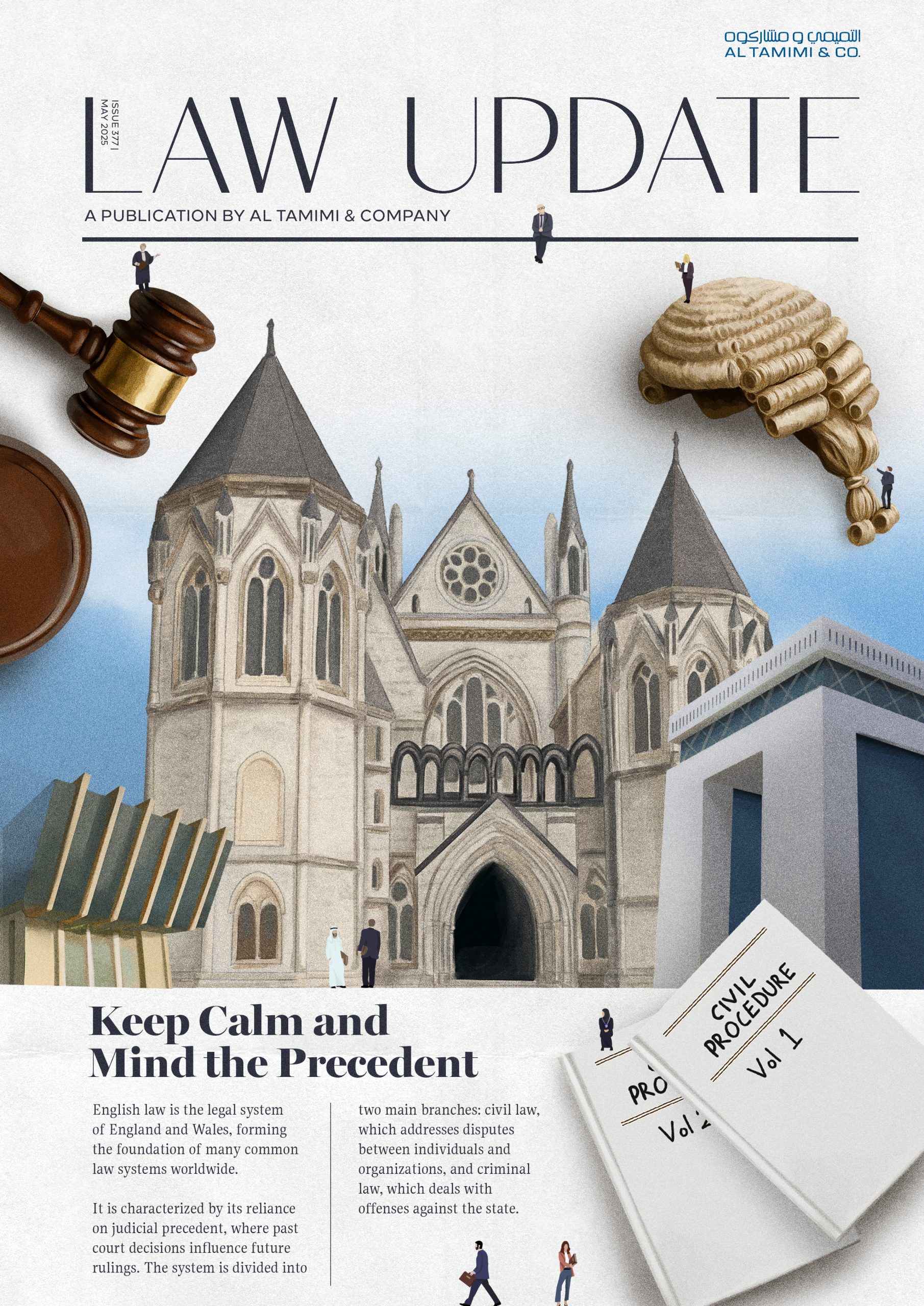

English Law: Keep calm and mind the precedent

In May Law Update’s edition, we examined the continued relevance of English law across MENA jurisdictions and why it remains a cornerstone of commercial transactions, dispute resolution, and cross-border deal structuring.

From the Dubai Court’s recognition of Without Prejudice communications to anti-sandbagging clauses, ESG, joint ventures, and the classification of warranties, our contributors explore how English legal concepts are being applied, interpreted, and adapted in a regional context.

With expert insight across sectors, including capital markets, corporate acquisitions, and estate planning, this issue underscores that familiarity with English law is no longer optional for businesses in MENA. It is essential.

2025 is set to be a game-changer for the MENA region, with legal and regulatory shifts from 2024 continuing to reshape its economic landscape. Saudi Arabia, the UAE, Egypt, Iraq, Qatar, and Bahrain are all implementing groundbreaking reforms in sustainable financing, investment laws, labor regulations, and dispute resolution. As the region positions itself for deeper global integration, businesses must adapt to a rapidly evolving legal environment.

Our Eyes on 2025 publication provides essential insights and practical guidance on the key legal updates shaping the year ahead—equipping you with the knowledge to stay ahead in this dynamic market.

The leading law firm in the Middle East & North Africa region.

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

-

Sectors

-

Country Groups

-

Client Solutions

Today's news and tomorrow's trends from around the region.

17 offices across the Middle East & North Africa.

Our Services

Back

Back

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

- Intellectual Property

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Projects

- Real Estate

- Regulatory

- Tax

- Turnaround, Restructuring & Insolvency

- Compliance, Investigations and White-Collar Crime

-

Sectors

-

Country Groups

-

Client Solutions

- Law Firm

- /

- Insights

- /

- Law Update

- /

- June 2014

- /

- Registration of Leases in Dubai

Registration of Leases in Dubai

Ravi Gill

June 2014

On 2 April 2014 the Dubai Land Department (“DLD”) issued Administrative Resolution No. 134 of 2013 ( “Resolution”) relating to the registration of leases in Dubai and resolving as follows:

- Any lease for a term of more than 10 years and up to 99 years shall be deemed a long term lease and registrable in accordance with Dubai Law No. 7 of 2006 Concerning Real Property Registration in The Emirate of Dubai (“Law No. 7”);

- Any lease for a term of 10 years or less shall be registrable in accordance with Dubai Law No. 33 of 2008 (amending the provisions of Law No. 26 of 2007) Regulating the Relationship Between Landlords and Tenants in the Emirate of Dubai.

What does this mean in practice?

What this effectively means is that leases referred to in category i) above are registrable as dispositions on the Real Property Register maintained by the DLD and leases falling within category ii) are registrable on the Ejari Register which is maintained by the Real Estate Regulatory Agency (“RERA”).

Law No. 7 mandated that rights of ownership of property in Dubai were restricted to UAE or GCC nationals or companies but that there would be specific areas as determined by the Ruler where foreign nationals could own freehold, usufruct and leasehold rights for periods not exceeding 99 years. Such rights would be registrable real property rights in the Real Property Register. However the law did not set a lower limit relating to the term of the lease for when a lease would constitute a registrable disposition on the Real Estate Register. It has been generally understood, based on DLD practice, that leases for over 10 years were registrable on the Real Estate Register but this was never formally codified in the law. We believe that the Resolution endeavours to provide final clarity on this.

In the meantime, and in practice, RERA has been accepting leases with terms up to 5 years as capable of being registered on the Ejari system. Therefore, prior to the Resolution a grey area began to emerge as to where leases with terms of more than 5 but less than 10 years were to be registered. There was no clear guidance on this in the law and we believe that the Resolution has been issued in an attempt to eradicate this grey area.

What difference does it make where a lease is registered?

First and foremost, one of the most important implications of whether a lease is registrable as a real property right on the Real Property Register or on the Ejari system is that the former is an ownership interest recognized as a right in rem and not just a contractual right.

As a registrable interest it means that it can be disposed of and a mortgage may be registered against it. Law No. 14 of 2008 Concerning Mortgages in the Emirate of Dubai states in Article 5 that a mortgagor must be the owner of the mortgaged property and that a mortgage may be created over property that is capable of being disposed of. This concept of ownership is not further defined and therefore arguably a tenant with a lease registered at DLD would technically fall within this category, thereby allowing the tenant to grant a legal registrable mortgage against the title of the leasehold interest.

The second key difference relates to the rate of registration fees payable for registration of leases in the different registers. Understandably, the registration of a real property right would be more expensive than registration in the Ejari system.

The latest resolution setting out fees concerning the DLD is Executive Council Resolution No. 30 of 2013, which states that the fee for registration of a long term leasehold interest is 4% of the “total value of rent contract”, discussed further below. It is often the case that a long term lease will be subject to a premium charged by the landlord at the outset followed by a lower annual rental sum during the remainder of the lease term. Alternatively, depending on what has been agreed between the parties, a long term lease may have no premium and a yearly escalating rent throughout the term instead. The question therefore arises as to how this 4% registration fee is calculated in practice.

As stated above the “total value of rent contract” needs to be determined in order for the fee to be calculated. The fee should be payable on the total value of rent payable throughout the term of the lease. If there is a premium payable at the commencement of the lease this would be included in the calculation of the fee. This resolution goes on to state in Article 3 that, unless agreed otherwise, 50% of the fee is payable by the landlord and 50% by the tenant. This effectively mirrors the rule for a sale and purchase transaction vis-à-vis a seller and purchaser and is subject to the same fine (double the fee due) if evaded.

The fee payable for a lease registered on the Ejari system is currently a flat fee and not linked to the rental value of the lease. As at the date of writing this article the fee is AED 160 plus typing charges of AED 35, therefore a total of AED 195.

Conclusion

We welcome the Resolution as providing clarity on the correct forum for the registration of leases according to the length of the term. This clarity will assist commercial tenants in knowing the full implications of entering into a lease with a term of over 10 years. In addition it provides clarity to lenders at the outset as to when they can seek to acquire a registered legal mortgage at the DLD when they provide financing to a tenant.

A grey area remains, however, where a lease of over 10 years is granted to a non UAE or GCC citizen or company, of land or property in an area which has not been designated by the Ruler as an area where foreigners can acquire freehold, usufruct or long leasehold interests. The law states that such an interest is not registrable on the Real Property Register and Article 26 of Law No. 7 states that any disposition granted which is not in accordance with the law is void. This is consistent with Article 1277 of the Civil Code of the UAE, which states that the “Ownership of real property or other rights in rem over real property may not be transferred between the two contracting parties so as to be valid against a third party save by registration in accordance with the special laws.” Such a lease is also incapable of being registered on Ejari as it is for a term exceeding 10 years.

The question therefore arises as to the validity of such a lease. There is an argument that despite such a lease being incapable of registration, it may still be enforceable on the basis of it conferring contractual rights on the parties to it. This would depend upon the court’s interpretation of the relevant provisions of Law No. 7 and the Civil Code. At the time of writing this article we are not aware of any court judgment that addresses this issue.

Stay updated

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below.