- Arbitration

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Find out more

Legacy: Putting the Family First

This comprehensive guide is designed to help you navigate the intricate landscape of family business and private wealth in the Middle East, where family businesses constitute approximately 60% of GDP and employ 80% of the workforce in the GCC, offering unparalleled opportunities for wealth creation and preservation.

Packed with insights, strategies, and expert advice from our talented lawyers, Legacy provides tailored solutions to the unique challenges of asset protection, succession planning, and dispute resolution in this dynamic region.Read the publication and equip yourself with the knowledge and tools necessary to thrive, whether you’re a seasoned investor, a family business owner, part of the next generation, or a newcomer exploring opportunities in the region.

Read Now

The leading law firm in the Middle East & North Africa region.

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

-

Sectors

-

Country Groups

-

Client Solutions

Today's news and tomorrow's trends from around the region.

17 offices across the Middle East & North Africa.

Our Services

Back

Back

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

- Intellectual Property

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Projects

- Real Estate

- Regulatory

- Tax

- Turnaround, Restructuring & Insolvency

- White Collar Crime & Investigations

-

Sectors

-

Country Groups

-

Client Solutions

- Law Firm

- /

- Insights

- /

- Law Update

- /

- March 2019

- /

- Real Estate Development in the Emirate of Sharjah

Real Estate Development in the Emirate of Sharjah

Salman Khaled

A new legal framework governing real estate development projects in Sharjah was recently introduced by the Sharjah Executive Council. Developers, real estate brokers and other consultants should carefully consider this new regime and, in particular, the expanded regulatory function of the Sharjah Real Estate Registration Department (‘SRERD’).

A new legal framework governing real estate development projects in Sharjah was recently introduced by the Sharjah Executive Council. Developers, real estate brokers and other consultants should carefully consider this new regime and, in particular, the expanded regulatory function of the Sharjah Real Estate Registration Department (‘SRERD’).

The applicable law is Executive Council Resolution No. (34) of 2018 on Selling Real Estate Units in the Emirate of Sharjah (‘Resolution’), which revokes the previous Executive Council Resolution No. (25) of 2011 and any other provisions inconsistent with the Resolution.

In this Article, we highlight and discuss the key elements of the Resolution.

SRERD – Expanded Regulatory Function

The Resolution provides SRERD with wider regulatory authority over real estate projects, and in particular, the ability to regulate and monitor off-plan developments (including aspects such as developer licensing, project registration, marketing and sales).

SRERD will also have responsibility for coordinating with other governmental or non-governmental bodies regarding the issue or suspension of relevant licences, and for supervision of development projects in the Emirate of Sharjah.

Project Registration – General

It is worth noting that the previous laws provided that project licences were granted on an exclusive basis to UAE nationals and GCC nationals. Other nationals must seek the approval of H.H. the Ruler of Sharjah.

The Resolution now provides in Article 4 that developers may be:

- UAE nationals and GCC nationals; or

- other nationalities (whether or not resident in the UAE) approved by H.H. the Ruler of Sharjah in respect of approved areas.

Project Registration – Additional Developer Obligations

The Resolution imposes a number of new obligations on developers, including the requirement to:

- provide SRERD a copy of the building permit issued by competent authorities;

- provide SRERD with a copy of the certificate of approval of name for the project issued by the competent authority; and

- open a bank account in the name of project, from which funds shall be allocated for construction and management of the project in accordance with the Resolution.

These obligations indicate that SRERD will actively and closely monitor developers and the progress of development projects in the Emirate of Sharjah.

Bank Guarantee – Retention Amount

Similar to the previous position, the Resolution requires that developers provide a bank guarantee to SRERD as a condition of project registration (20 percent of the project value).

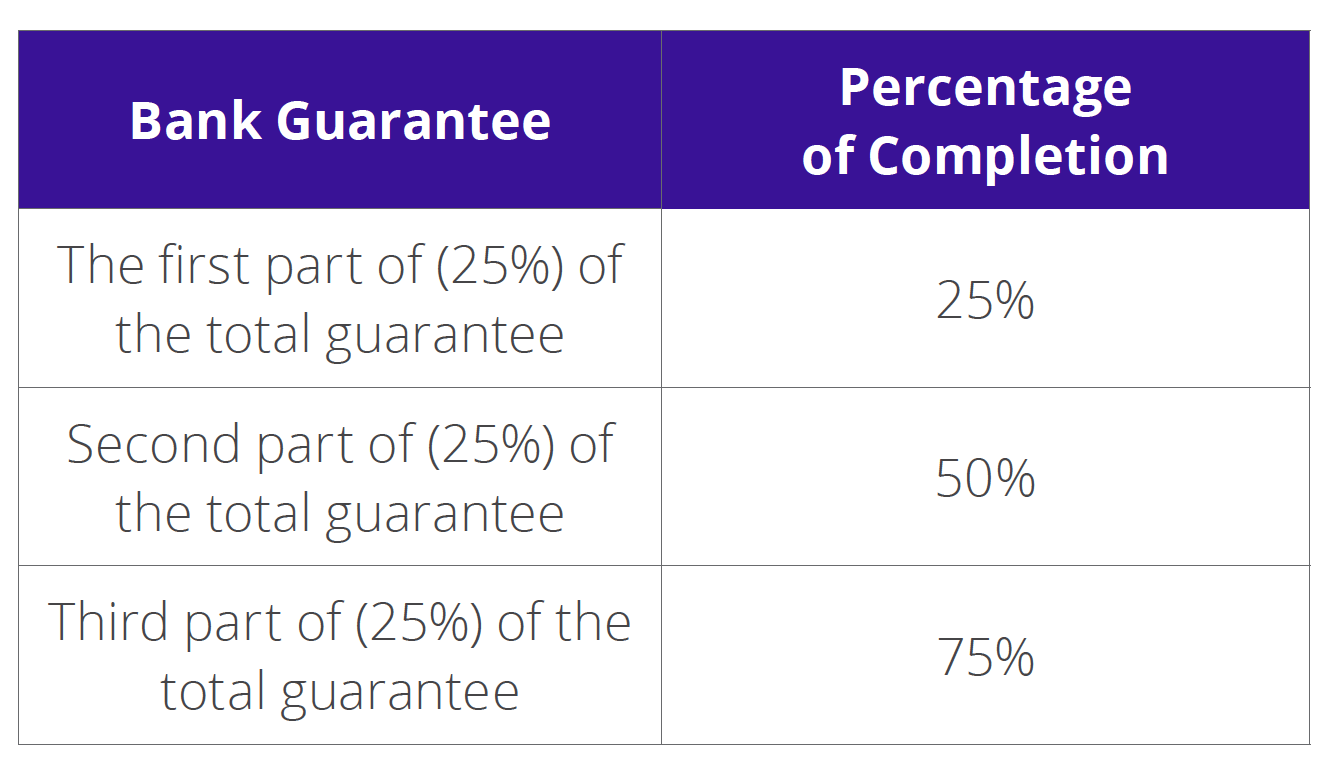

The Resolution divides the bank guarantee into four parts, where the first, second and third parts are released after the developer submits a technical report confirming the project completion percentage certified by the relevant authorities in the following manner:

With respect to the release of the final 25 percent of the total guarantee, the Resolution requires that the following conditions now be satisfied:

- the release of any mortgage affecting the property;

- the developer has rectified any violations under the Resolution or applicable law, if any;

- the connection of public services and utilities to the project;

- a clearance certificate has been issued by Sharjah Electricity and Water Authority;

- a certificate of completion has been obtained from Sharjah Municipality or the Roads and Transport Authority (‘RTA’);

- sub-division of the development project and determine the areas in a scheme approved by the Sharjah Directorate of Town Planning and Survey;

- all conditions and obligations arising from the plot purchase contract and with the government authorities have been fulfilled; and

- title deeds (freehold or usufruct) for units in the project have been issued by SRERD.

Project Mortgage – Restrictions

Article 7 of the Resolution states that any property mortgage/development finance must be exclusively allocated for the construction, implementation and management of the project.

It further states that finance value shall not exceed (50 percent) of the project value (as approved in the building permit issued by the municipality or approved by infrastructure licence of the RTA). This value may be increased in exceptional cases with the consent of and under the conditions determined by the Sharjah Executive Council.

Further, Article 8 states that SRERD shall review the mortgage contract between the developer and the mortgagee before it is executed. SRERD may also contact the banks operating in the UAE, including the Central Bank, to ensure that any decisions issued by SRERD in this regard are put into effect and also to obtain proof of the release of the relevant mortgage prior to issuance of the building completion certificate for the project.

In line with the real estate laws in the Emirate of Sharjah, the real estate mortgage shall be valid only after registration.

Payment Milestones for Off-Plan Sales

Article 9 of the Resolution prescribes that purchasers’ payments due under an off-plan sale and purchase agreement must be in proportion to the construction progress for the project. That progress shall be determined by the project status reports issued by Sharjah Municipality or the RTA (as applicable).

Further, the value of the first instalment paid by the purchaser must not exceed (20 percent) of the purchase price, unless the parties expressly agreed otherwise in the sale and purchase agreement.

Registration Fees

The Resolution provides for the following registration fees to be paid:

- if the purchaser is a UAE national or GCC national: one percent of the purchase price paid by the seller and two percent of the purchase price paid by the purchaser; or

- if the purchaser is not a UAE national or GCC national: four percent of the purchase price fully paid by the purchaser.

SRERD and the relevant authorities shall not register sale contracts that are not in the form ratified by SRERD.

Management of the Development

The Resolution retains the previous requirement that following completion, a developer retains ownership of at least 10 percent of the units in a project.

The Resolution now provides an alternative to that approach, whereby the developer may provide SRERD with a bank guarantee equal to 10 percent of the project value. This guarantee must be unconditional and payable on demand.

A developer may not dispose of the retained units or, if applicable, request the release of the bank guarantee unless it provides proof of the establishment of a unit owners’ association for the project, including the election of its board of directors in accordance withLaw No. (4) of 1980 Regulating Ownership of Multi-Storey Buildings, and any other relevant legislation in this regard.

Marketing of Real Estate Development Projects

Compared with the previous laws, the Resolution sets further obligations on the marketing and advertising of development projects in the Emirate of Sharjah. These include:

- subject to coordination with the other relevant authorities, SRERD shall be responsible for issuing advertising permits for the marketing and sale of all properties;

- all owners, developers and licenced real estate brokers in the Emirate of Sharjah must obtain written approval from SRERD prior to advertising properties for sale in various media, social networking sites and any other means; and

- licenced real estate brokers outside the Emirate of Sharjah must obtain SRERD’s prior approval to advertise projects located in the Emirate of Sharjah.

It is apparent from the above that SRERD intends to take a stricter approach with respect to the marketing and advertising of development projects.

Cancellation of Real Estate Development Projects

The Resolution generally retains the previous regime for a developer to seek cancellation of a registered project.

Developers must still apply to SRERD for cancellation and provide details in support. If SRERD, in its discretion, accepts the developer’s application, then the developer must follow a notification procedure.

Importantly, there is now a requirement that notification of the proposed project cancellation be published in two local newspapers and in both Arabic and English, using the prescribed form of declaration.

As per the previous regime the developer must also notify the purchaser(s) of the proposed cancellation of a development project through registered mail.

The time period in which purchaser(s) must notify SRERD of their objection to the cancellation application remains at 15 days from the date of receiving the developer’s notification.

If the relevant period expires, without objection by any purchaser, then the cancellation procedures of the registration or suspension of services for the project shall be completed by SRERD and the relevant competent authorities. However, if a purchaser objects to the cancellation of the project, within the period specified in the declaration, then the cancellation procedures shall be suspended by SRERD until the developer has settled all related disputes and objections.

Violations and Penalties

The Resolution broadens the scope of violations, and it identifies further violations that are subject to penalties. These are detailed in the schedule attached to the Resolution.

In summary, the penalty regime prescribes that:

- penalties may be imposed for the contravention of the Resolution and decisions issued thereunder;

- the penalty amount may be doubled in the event of a repeat violation within one year from the date of the first violation;

- in the case of repeat infringements, relevant authorities may temporarily or permanently cancel or suspend the developer’s licence; and

- concerned parties shall refrain from continuing to provide government services and stop all work, unless a defaulting developer amends all violations within the period determined by SRERD in accordance with the Resolution.

In conclusion, the issuance of the Resolution provides SRERD (and other relevant authorities in coordination with SRERD) with wider regulatory authority over real estate development projects in the Emirate of Sharjah. The authority for SRERD to more rigorously monitor and ensure compliance by developers and other parties operating in the real estate market in the Emirate of Sharjah can only boost confidence of investors in the real estate sector. Developers, in particular, should familiarise themselves with these new regulations to ensure compliance going forward.

Al Tamimi & Company’s Real Estate team regularly advises on real estate matters. For further information, please contact Andrew Balfe (a.balfe@tamimi.com) or Salman Khaled (s.khaled@tamimi.com).

Stay updated

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below.