- Arbitration

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Find out more

Real Estate & Construction and Hotels & Leisure

Real estate, construction, and hospitality are at the forefront of transformation across the Middle East – reshaping cities, driving investment, and demanding increasingly sophisticated legal frameworks.

In the June edition of Law Update, we take a closer look at the legal shifts influencing the sector – from Dubai’s new Real Estate Investment Funds Law and major reforms in Qatar, to Bahrain’s push toward digitalisation in property and timeshare regulation. We also explore practical issues around strata, zoning, joint ventures, and hotel management agreements that are critical to navigating today’s market.

As the landscape becomes more complex, understanding the legal dynamics behind these developments is key to making informed, strategic decisions.

2025 is set to be a game-changer for the MENA region, with legal and regulatory shifts from 2024 continuing to reshape its economic landscape. Saudi Arabia, the UAE, Egypt, Iraq, Qatar, and Bahrain are all implementing groundbreaking reforms in sustainable financing, investment laws, labor regulations, and dispute resolution. As the region positions itself for deeper global integration, businesses must adapt to a rapidly evolving legal environment.

Our Eyes on 2025 publication provides essential insights and practical guidance on the key legal updates shaping the year ahead—equipping you with the knowledge to stay ahead in this dynamic market.

The leading law firm in the Middle East & North Africa region.

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

-

Sectors

-

Country Groups

-

Client Solutions

Today's news and tomorrow's trends from around the region.

17 offices across the Middle East & North Africa.

Our Services

Back

Back

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

- Intellectual Property

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Projects

- Real Estate

- Regulatory

- Tax

- Turnaround, Restructuring & Insolvency

- Compliance, Investigations and White-Collar Crime

-

Sectors

-

Country Groups

-

Client Solutions

- Law Firm

- /

- Insights

- /

- Law Update

- /

- Venture Capital & Emerging Companies Law Review

- /

- ESOP in Venture Capital

ESOP in Venture Capital

Abdullah Mutawi - Partner, Head of Corporate Commercial - Corporate / Mergers and Acquisitions / Commercial / Private Equity / Digital & Data / Turnaround, Restructuring and Insolvency / Venture Capital and Emerging Companies

Kareem Zureikat - Senior Associate - Corporate / Mergers and Acquisitions / Commercial / Venture Capital and Emerging Companies

Haya Al-Barqawi

“Investors and founders underestimate the importance of an adequately sized and well-structured ESOP as part of their capital structure. As the talent pool in the region grows and as the number of second-time entrepreneurs bring their ideas to market, meaningful stock options are going to be an essential part of the compensation toolkit for founders who want to attract the best people while maintaining capital efficiency. We have been preparing best-in-class ESOP plans for several years which are adapted to local market norms and local laws as required.”

The key to any great start-up are its employees; those that have been there with the founders from the start and those that join later on and help grow the business. With limited cash at the start, and with long working hours and the uncertain future of the business, it isn’t always easy for a budding start-up to lure the best talent in the market. This is why start-ups offer employees a share in the ownership of the company. This idea of ownership is one of the key incentives that will attract top talent to the company, and comes in the form of a share incentive scheme, also known as an employee share option plan (“ESOP”). ESOPs align the employee’s goals with that of the company’s, as the employee benefits from the company’s growth.

ESOPs come in a variety of shapes and sizes, the most common are:

- Standard share option schemes;

- Stock purchase plans;

- Restricted stock unit plans; and

- Phantom share plans.

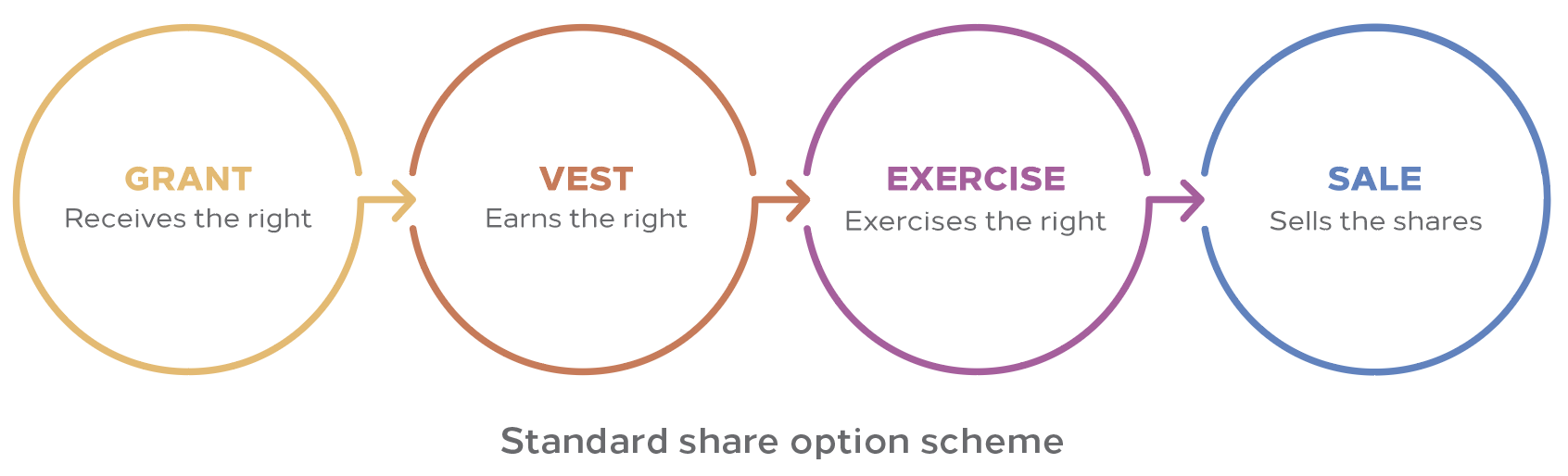

Standard share option schemes work exactly as described in figure 1 below; the grant, vesting, and exercise of options. While the share option scheme grants the employee the right to options, stock purchase plans grant the employee the right the purchase shares usually at a discount from fair market value. Restricted stock unit plans work quite differently, as under this plan an employee is awarded the right to receive shares, without having to purchase them, on a pre-determined date subject to fulfilment of specified conditions or the achievement of certain targets. Different still are phantom share plans, which are a form of long-term deferred compensation using the start-ups shares as the measuring device for calculating the value of the deferred compensation; the company simply credits these phantom shares on its books and as the value of the company’s shares rises or falls, so does the value of the phantom stock.

While ESOP schemes may differ, they all share the same essential purpose of retaining, rewarding and incentivising employees. ESOPs are options given to an employee and may be exercised for shares or cash in lieu at some point. They involve 4 main stages: the grant of the options, the vesting of the options, the exercise of the options, and the sale of the exercised options. ESOPs are normally offered to employees at a pre-determined price. The vesting schedule is typically a period of three to four years, during which shares vest in milestone-linked or periodic (e.g. quarterly or monthly) tranches. Typically, there will be a ‘cliff’ which is a specific date within the vesting timetable which crystallises the first vesting (even if multiple vesting milestones have been passed. For example, if there is a cliff at the one-year mark (which is typical), an employee leaving within the first year would not be entitled to any shares, and all the shares that should have vested within the first year vest at the same time at the one-year mark. Afterwards, the determined schedule applies normally. This allows companies to retain their top talent, and to motivate them due to the personal stake they hold in the success of the company.

Should an employee leave the business before the end of the three-year or four-year mark, they only have rights to the option shares that have already vested at the time, and the employee’s ability to keep those options will likely depend on whether their departure from the start-up was due to mutual agreement and/or resignation (good leaver) or due to a dismissal for cause (bad leaver). The inclusion of these good-leaver and bad-leaver provisions is important, as the founders will not want former employees retaining ownership in the start-up once they have left, particularly if the employee was a bad leaver.

A point that founders would need to keep in mind is that it is important to look at ESOP plans in the long-term. As mentioned above, an ESOP is one incentive the company can use to lure talent its way. As start-ups grow, this will undoubtedly require the hiring of further employees and it is essential that the start-up has the hiring capacity to keep up with such changes.

It is important to note that the creation of ESOP equity pools has the effect of diluting the ownership of existing shareholders in the start-up. Therefore, investors and founders should be alive to the fact that the size of the ESOP pool, and the dilutive effect the pool will have on each of them, is discussed and agreed during negotiations. It is also important for the founder and investors to agree to the valuation bearing in mind the current ESOP pool, and whether any increases to the ESOP pool will be required in connection with the new funding round. Here, it is important to ensure that the uses of the terms ‘pre-money valuation’ and ‘post-money valuation’ specify whether they include or exclude the ESOP pool or any increases to the ESOP pool. Otherwise, disagreements may arise when share prices and share allocations are made in a funding round.

When planning on setting up an ESOP, there are many factors that a company should take into account, such as the value of the shares to be granted, the terms of the share option agreement, and the number of shares the company is willing to offer, to name a few. One important element that often arises with founders is how the ESOP will be implemented given the terms of the company’s constitutional documents and the classes of shares available. Therefore, due consideration should be given to the jurisdiction of incorporation, as the laws of the jurisdiction can determine the degree of flexibility the start-up has in terms of what it can include in its constitutional documents with respect to the ESOP, including its ability to issue different classes of shares and specify the rights that attach to them.

Whether you are the founder or an investor, legal advice with respect to employee share option plans is an absolute must, as it may have significant repercussions on the economics of the start-up and its ability to attract the required talent for the business.

Stay updated

To learn more about our services and get the latest legal insights from across the Middle East and North Africa region, click on the link below.