- Arbitration

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Compliance, Investigations & International Cooperation

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Find out more

The Technology Issue

Decoding the future of law

This Technology Issue explores how digital transformation is reshaping legal frameworks across the region. From AI and data governance to IP, cybersecurity, and sector-specific innovation, our lawyers examine the fast-evolving regulatory landscape and its impact on businesses today.

Introduced by David Yates, Partner and Head of Technology, this edition offers concise insights to help you navigate an increasingly digital era.

2025 is set to be a game-changer for the MENA region, with legal and regulatory shifts from 2024 continuing to reshape its economic landscape. Saudi Arabia, the UAE, Egypt, Iraq, Qatar, and Bahrain are all implementing groundbreaking reforms in sustainable financing, investment laws, labor regulations, and dispute resolution. As the region positions itself for deeper global integration, businesses must adapt to a rapidly evolving legal environment.

Our Eyes on 2025 publication provides essential insights and practical guidance on the key legal updates shaping the year ahead—equipping you with the knowledge to stay ahead in this dynamic market.

The leading law firm in the Middle East & North Africa region.

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Compliance, Investigations & International Cooperation

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

-

Sectors

-

Country Groups

-

Client Solutions

Today's news and tomorrow's trends from around the region.

17 offices across the Middle East & North Africa.

Our Services

Back

Back

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Compliance, Investigations & International Cooperation

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

- Intellectual Property

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Projects

- Real Estate

- Regulatory

- Tax

- Turnaround, Restructuring & Insolvency

-

Sectors

-

Country Groups

-

Client Solutions

UN Security Council Revives Iran Sanctions: What Does This Mean for MENA Businesses?

6 min 41 sec

January 18, 2026 (Edited)

6 min 41 sec

January 18, 2026 (Edited)

On the evening of 28 September 2025 (following the 30-day window triggered on 28 August 2025), the United Nations Security Council (UNSC) took a decisive step by reimposing a raft of sanctions on Iran, after formally determining that Tehran had engaged in “significant non-performance” of its nuclear obligations. The process began on 28 August 2024 when France, Germany, and the United Kingdom (the “E3”) notified the Council, starting the snapback mechanism under UNSC Resolution 2231. The snapback concluded in late September 2025, restoring the UN nuclear-related sanctions, with the EU and UK also announcing parallel measures on 28-29 September 2025. Looking at 2026, these parallel measures create a reinforced sanctions architecture requiring heightened compliance vigilance across multiple jurisdictions.

This action revives UN measures that had been lifted in January 2016 under the Joint Comprehensive Plan of Action (JCPOA), underlining once again the binding effect of Security Council decisions. While such measures apply to all member states, the impact is particularly felt in in the Middle East and North Africa (MENA) region, where many countries implement UNSC sanctions as members of the UN, rather than having separate sanctions frameworks.

The sanctions framework now in effect was triggered by the snapback mechanism embedded in UNSC Resolution 2231.The snapback, designed as a safeguard, allows previously suspended sanctions to automatically resume when a violation is flagged, without the possibility of being blocked by a veto once the 30-day window runs. It was formally activated by the E3 notification on 28 August 2025. In 2026, the geopolitical dynamics surrounding these sanctions will continue to evolve, requiring businesses to monitor developments closely.

To fully understand the current development, it is important to recall the JCPOA’s origins. Concluded on 14 July 2015 between the five permanent UNSC members (China, France, Russia, the UK, and the U.S.), along with Germany and the EU, the agreement was intended to ensure that Iran’s nuclear program remained exclusively peaceful. Resolution 2231 provided phased sanctions relief from 16 January 2016 but crucially preserved the snapback clause as a deterrent against non-compliance.

Recent Trends in the MENA Region: FATF Evaluations and the Renewed Sanctions Landscape

As businesses enter 2026, the UNSC underscores the ongoing gravity of global proliferation concerns and the operational realities under a reimposed sanctions framework. These measures revive restrictions on nuclear-related equipment, arms transfers, petroleum and petrochemicals, gold and precious metals, and financial dealings with designated Iranian entities. While many of these prohibitions are familiar, their renewed enforcement brings sharper compliance obligations and operational challenges. Companies, particularly those transacting through Gulf financial centres and regional trade corridors, should anticipate heightened regulatory scrutiny and act proactively to mitigate risks.

This evolving landscape is further amplified by the UAE’s next FATF Mutual Evaluation, anticipated to take place in 2026 as part of the FATF’s fifth round of assessments, following the UAE’s exit from the grey list in February 2024. Coupled with recent regulatory reforms, including the new AML law, Cabinet regulations, and enhanced enforcement actions, these developments create a more rigorous compliance environment. For companies entering the UAE market, this combination of sanctions enforcement, regulatory reform, and international scrutiny not only elevates compliance expectations but also underscores the importance of robust risk frameworks, transactional diligence, and proactive engagement with local authorities.

Note: The above lists the jurisdictions where Al Tamimi & Company operates.

As also acknowledged in some of the most recent Financial Action Task Force (FATF) Mutual Evaluation Reports (MER), MENA jurisdictions have been taking necessary legal steps to give direct and immediate effect to UNSC resolutions. To highlight a few observations from the MER of certain countries, please note the following:

- Iraq: Through its 2015 AML/CFT law, reinforced by amendments in 2022, Iraq created a dedicated Committee for Freezing Terrorist Funds and extended its framework to cover proliferation financing, thereby meeting UNSCR obligations.

- Oman: Introduced mechanisms to implement UN-mandated Targeted Financial Sanctions (TFS) by introducing new Committee decisions including but not limited to National Counter-Terrorism Committee Decision No. 01/2022, integrated sanctions compliance into supervisory oversight, and undertaken risk assessments of the non-profit sector.

- Qatar: Enhanced supervision of both financial institutions and designated non-financial businesses and professions (DNFBPs), introduced new beneficial ownership requirements, and published new guidance including the Guidance on Implementation of an Effective Sanctions Compliance Programme in 2025 as released by the Qatar Financial Centre Regulatory Authority.

- Saudi Arabia: The 2018 FATF MER confirmed that Riyadh had established a comprehensive legal framework to implement TFS, noted its role in co-sponsoring designations at the UN 1267 and maintaining a domestic mechanism for UNSCR 1373 listings. The evaluation recognised the country’s ongoing building capacity to freeze assets and enforce restrictions automatically upon UN designation.

- UAE: Established a dedicated committee and workflow outlining the process for receiving updates from the UNSC regarding UN sanctions lists to ensure they promptly circulated to all relevant authorities responsible for enforcement, enabling necessary measures to be taken within 24 hours.

Regional Business Implications: What to expect?

The measures outlined above overlap with U.S. and EU restrictions already in force, but they raise the compliance bar by obliging companies to show proactive alignment and to anticipate closer oversight by regulators and international partners. Key sectors of exposure extend well beyond traditional banking and finance, requiring cross-functional compliance reviews rather than treating sanctions adherence as solely a finance department concern. These sectors include:

- Banking and Finance

- Trade, Logistics and Shipping

- Energy and Commodities

- Corporate Governance

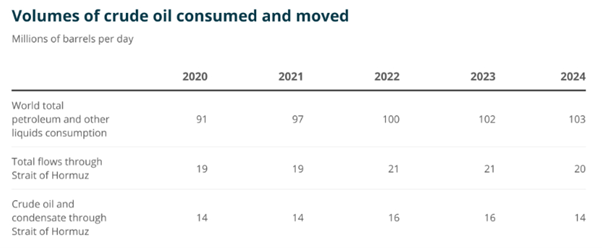

For 2026 planning purposes, companies should prioritize reviewing any stakeholders with actual or potential Iran exposure and consider how the return of sectoral restrictions spanning asset freezes, oil gas, shipping, technology, and financial services could bear on current relationships or related transactions. Looking ahead, businesses must also account for the heightened risk of instability in critical maritime corridors. For MENA states, whose economies are tightly bound to secure energy exports, such disruption risks remain material considerations for 2026 operational planning. Even limited sabotage on tankers can send insurance premiums soaring, complicating supply contracts and raising operational costs for regional energy and shipping companies. As context for 2026 energy market planning, global consumption is set to average 103.5m barrels per day (bpd) in 2025, rising to 105m bpd in 2026, according to the US Energy Information Administration (EIA). Please refer to the below for the most recent consumption volume statistics:

Source: Control Risks, The State of Hormuz

As reported last by Control Risks in August 2025, Saudi Arabia is the single largest exporter, sending an estimated 5.5m bpd through the waterway to predominantly Asian export markets. Any interference, however limited, is expected to raise insurance premiums, complicates supply contracts, and inflates costs for energy and shipping firms across the Gulf.

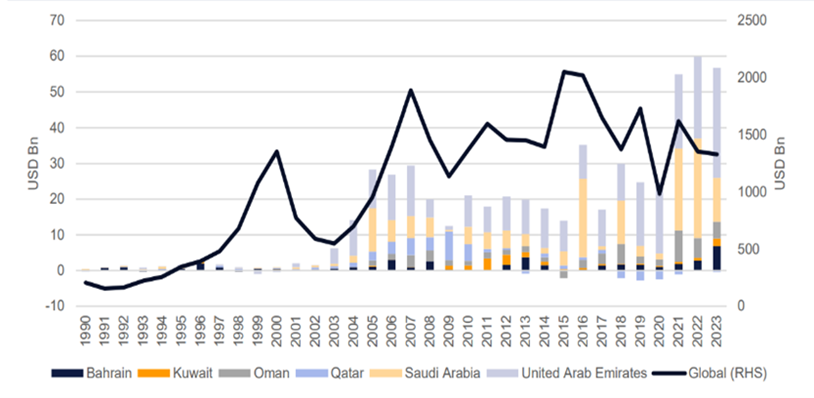

Source: Control Risks, The State of Hormuz

At the same time, macroeconomic trends are pulling in the opposite direction. Despite the sensitive environment surrounding sanctions including the latest updates in relation to Syria, in its June 19, 2025, press release titled “GCC: Growth on the Rise, but Smart Spending Will Shape a Thriving Future,” the World Bank projected GCC economic growth to reach 3.2% in 2025 and 4.5% in 2026, with gradual easing of OPEC+ output caps and continued dynamism in non-oil sectors such as manufacturing, logistics, and services. Core sectors, tourism, logistics, infrastructure, remain attractive, while new investment is flowing into green hydrogen, digital infrastructure, and advanced mobility. Sovereign wealth funds are increasingly turning inward, reinforcing national resilience and showing sustained confidence in local fundamentals. See below figures of the recent past for reference:

Source: UNCTAD World Investment Report 2024, Emirates NBD Research

Strategic Priorities for 2026

As we embark upon the new year and beyond, companies operating in the MENA region are expected not only to seize expansion opportunities but also to ensure that their strategies, counterparties, and supply chains do not inadvertently expose them to sanctions circumvention inquiries. In the evolving compliance landscape, growth and regulatory adherence are inseparable imperatives.

For MENA businesses, the reimposed sanctions framework represents both a legal obligation and a strategic consideration for future planning. Legally, it reinforces the obligation to maintain strict sanctions compliance across the board including banking, trade, energy, and investment channels. Commercially, it highlights the need for resilience planning in an environment where maritime disruption, heightened due diligence, and regulatory audits are increasingly the norm.

Written by

Ibtissem Lassoued

Partner, Head of Compliance, Investigations & International Cooperation

Next Article

Written by

Ibtissem Lassoued

Partner, Head of Compliance, Investigations & International Cooperation