- Arbitration

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Compliance, Investigations & International Cooperation

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Find out more

The Technology Issue

Decoding the future of law

This Technology Issue explores how digital transformation is reshaping legal frameworks across the region. From AI and data governance to IP, cybersecurity, and sector-specific innovation, our lawyers examine the fast-evolving regulatory landscape and its impact on businesses today.

Introduced by David Yates, Partner and Head of Technology, this edition offers concise insights to help you navigate an increasingly digital era.

2025 is set to be a game-changer for the MENA region, with legal and regulatory shifts from 2024 continuing to reshape its economic landscape. Saudi Arabia, the UAE, Egypt, Iraq, Qatar, and Bahrain are all implementing groundbreaking reforms in sustainable financing, investment laws, labor regulations, and dispute resolution. As the region positions itself for deeper global integration, businesses must adapt to a rapidly evolving legal environment.

Our Eyes on 2025 publication provides essential insights and practical guidance on the key legal updates shaping the year ahead—equipping you with the knowledge to stay ahead in this dynamic market.

The leading law firm in the Middle East & North Africa region.

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Compliance, Investigations & International Cooperation

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

-

Sectors

-

Country Groups

-

Client Solutions

Today's news and tomorrow's trends from around the region.

17 offices across the Middle East & North Africa.

Our Services

Back

Back

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Compliance, Investigations & International Cooperation

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

- Intellectual Property

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Projects

- Real Estate

- Regulatory

- Tax

- Turnaround, Restructuring & Insolvency

-

Sectors

-

Country Groups

-

Client Solutions

The UAE’s AML Framework: Navigating a New Era of Financial Crime Compliance in 2026

6 min 53 sec

January 18, 2026 (Edited)

6 min 53 sec

January 18, 2026 (Edited)

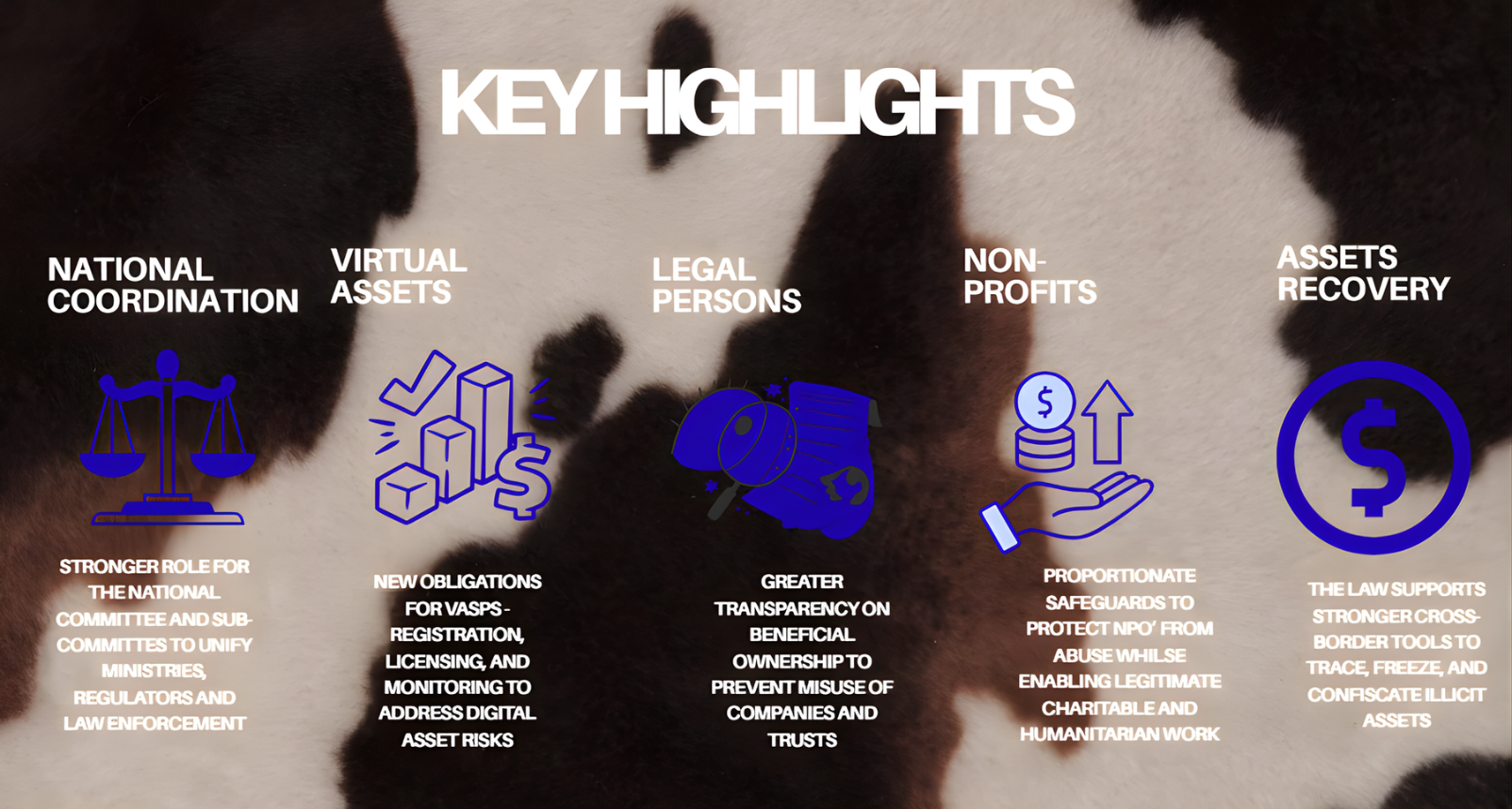

As part of its broader, ongoing drive to strengthen enforcement against financial crime, the United Arab Emirates has introduced a far-reaching new law aimed at reinforcing its framework for combating money laundering, terrorist financing, and the financing of weapons proliferation. Federal Decree-Law No. 10 of 2025 on Anti-Money Laundering, Combating the Financing of Terrorism and Countering Proliferation Financing (the “New AML Law”), issued in October 2025 and effective 14 October 2025, repeals and replaces the Federal Law No. (20) of 2018 on Anti-money Laundering and Combating the Financing of Terrorism and Illegal Organisations, ushering in a stricter and more comprehensive regime. The Cabinet Resolution No. 134 of 2025 (the “Resolution”) cameinto force on 14 December 2025, replacing the previous Cabinet Resolution No. 10 of 2019.

This Resolution implements the executive regulations of Federal Decree-Law No. 10 of 2025, issued earlier this year on 30 September 2025, and governs Anti-Money Laundering (AML), Combating the Financing of Terrorism (CFT), and Countering the Financing of Proliferation (CPF). Comprising 71 articles and nearly 300 enforceable requirements, the Resolution translates high-level policy into concrete, actionable standards. It establishes the UAE’s most comprehensive and operationally detailed anti-money laundering, counter-terrorist financing, and counter-proliferation framework to date, providing clear, measurable expectations for all Regulated Entities, including financial institutions, Designated Non-Financial Businesses and Professions (DNFBPs), and Virtual Asset Service Providers (VASPs).

Proliferation Financing as the Third Pillar

For the first time, the title of the legislation explicitly includes Countering Proliferation Financing, replacing the earlier reference to illegal organisations. This change reflects a deliberate policy shift: the law now introduces standalone offences for financing the proliferation of arms and weapons of mass destruction, supported by new statutory definitions. Proliferation Financing, long treated as a side issue, is now officially on par with Anti-Money Laundering and Counter-Terrorist Financing under the country’s revamped financial crime framework. The Resolution now requires banks, financial institutions, virtual asset providers, and other regulated entities to spot, assess, and curb PF risks across their entire operations. The move marks a clear departure from past practice, where PF risks were often buried within broader AML programs. Under the new rules, entities must integrate PF oversight into enterprise-wide risk assessments (EWRA), customer due diligence, and transaction monitoring.

Expanded Legal Scope and Definitions

The New AML Law significantly broadens the scope of regulated activity and introduces several key definitional changes that extend criminal and compliance obligations alike, including:

- The concept of a Predicate Offence has been clarified to expressly include tax evasion (both direct and indirect), widening the base of underlying crimes from which illicit proceeds may originate.

- Recognising the rapid growth of digital finance, the law now provides that money laundering and terrorist financing offences can be committed through digital systems, virtual assets, or encryption technologies language that did not appear in the 2018 law.

- The definition of ‘Proceeds’ has been expanded to capture recurring or derivative benefits not only profits but also any other advantage derived from criminal property closing potential loopholes on indirect gains.

- A person may now be held liable not only if they knew that funds originated from criminal conduct but also if they should reasonably have known, introducing a lower threshold of awareness similar to negligence-based standards seen in other jurisdictions.

This marks a significant shift from the prior regime and signals the UAE’s intent to ensure accountability even where intent may be difficult to prove.

Commercial Gaming Operators Under Scrutiny

Commercial gaming operators, including casinos, online gaming platforms, and e-sports operators are now formally recognized as DNFBPs under the UAE AML-CFT-CPF regime. The reporting threshold for online transactions has been set at AED 11,000, whether in a single transaction or cumulatively across linked transactions. Senior management is expected to personally approve internal policies and oversee high-risk relationships, particularly those involving proliferation financing risks.

The new reporting and oversight requirements take on particular significance in the casino and gaming sectors, where high-value transactions and complex customer activity can obscure illicit flows. This becomes especially relevant considering how federal authorities in the UAE are expanding plans around casinos, lotteries, and other gaming activities. The federal General Commercial Gaming Regulatory Authority (GCGRA) now oversees the licensing and regulation of commercial gaming and national lottery operations across the Emirates. In parallel, significant projects such as the Wynn Al Marjan Island resort in Ras Al Khaimah, planned to open in 2027, are positioning the UAE to host its first legal casino and integrated entertainment destination.

Virtual Asset Service Providers

VASPs are now fully aligned with conventional financial institutions in their AML-CFT-CPF obligations. They must adhere to the Travel Rule, ensuring virtual asset transfers carry full information on both senders and receivers. Screening for sanctions and PF risks must be continuous, and record-keeping obligations extend to at least five years. VASPs are further prohibited from facilitating transactions that obscure the origin of funds or the identity of beneficial owners. For executives and compliance teams, operational requirements are substantial: real-time monitoring, governance oversight, and structured reporting mechanisms are now mandatory.

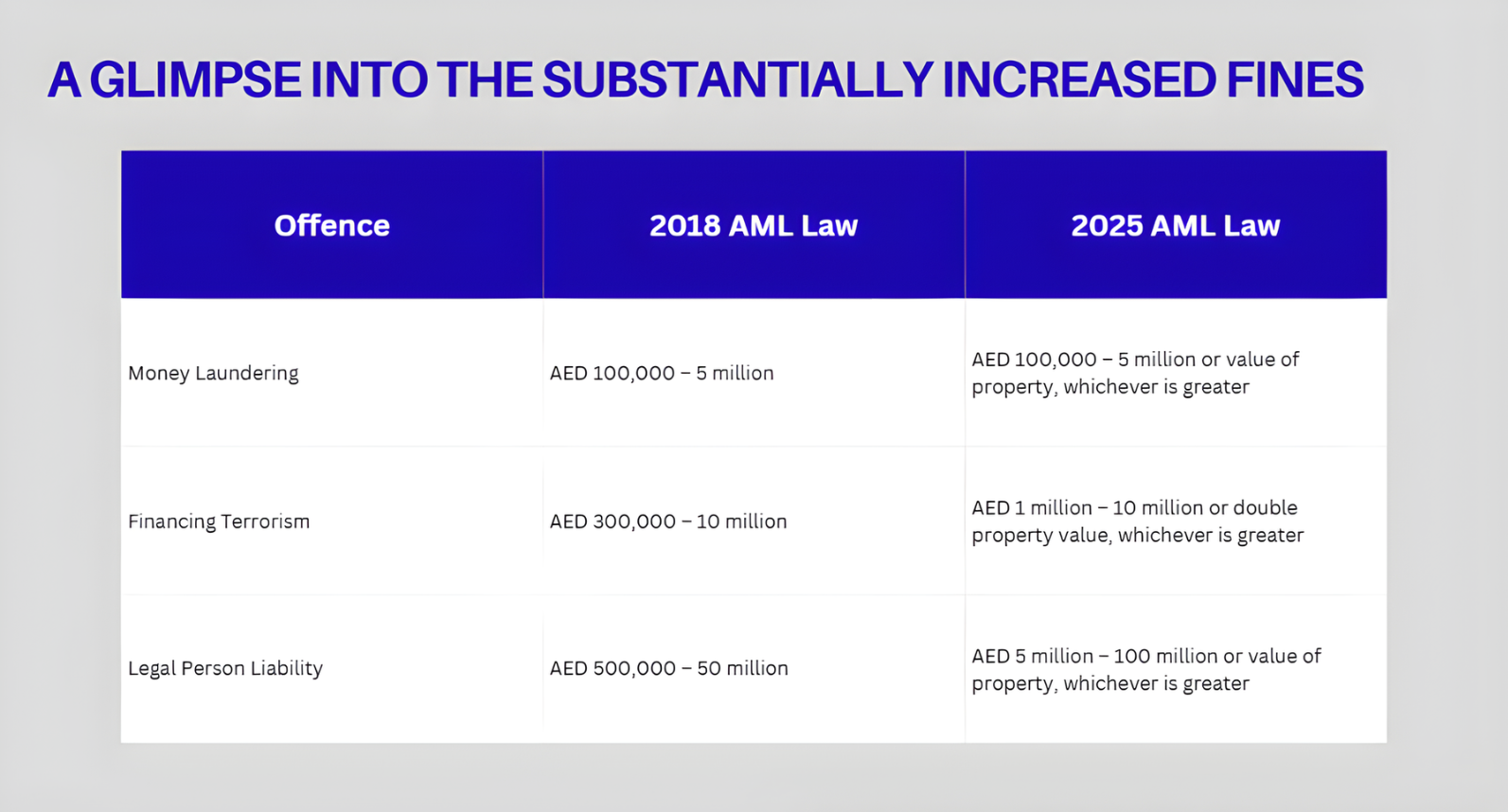

Enhanced Enforcement Powers

Article 5 empowers the Head of the FIU to suspend transactions for up to ten working days and freeze funds for up to thirty days, extendable by the Public Prosecutor. Under the 2018 law, these powers were limited to seven days and rested with the Central Bank Governor.

The new definitions separate freezing from seizure measures. A Seizure Order may extend for up to 10 days (extendable) and transfers control of the assets to the competent authority. A Freezing Order may last 30 days (extendable) and restricts the holder’s use, transfer, or disposal of assets while leaving them in their possession.

Article 22 introduces a comprehensive asset recovery mechanism, to be elaborated by forthcoming Cabinet regulations. It provides for confiscation and management of criminal property while safeguarding the rights of bona fide third parties.

Courts in the UAE are now authorized to enforce foreign judicial orders, including provisional measures and the confiscation of criminal assets, without conducting a separate local investigation. The reform is expected to streamline efforts by foreign authorities seeking to recover assets tied to financial crimes, corruption, or other criminal activities within the Emirates.

Lowered Threshold for Liability

A key feature of the Resolution is the lowering of the threshold for establishing liability for Principal Offences as defined under the Resolution. Previously, liability depended on actual knowledge of illicit funds, a subjective standard that often-limited enforcement. The revised framework allows knowledge to be inferred objectively, a person may now be held liable if they either knew or should reasonably have known that funds were illicit.

The Resolution also rolls out a new offence targeting the misuse of accounts in financial institutions or VASPs. Individuals who allow third parties to exploit such accounts, whether knowingly or where circumstances objectively suggest intent, are now criminally liable.

Personal Accountability and Continuous Monitoring

Senior management now bears explicit personal responsibility for compliance across all AML-CFT-CPF pillars. Executives must approve internal policies, oversee high-risk clients, and monitor program implementation. Enhanced beneficial ownership identification, including 25% ownership thresholds and fallback to senior officials, eliminates ambiguity and strengthens transparency.

Transaction monitoring is now continuous, exhaustive, and enforceable. Wire transfers and virtual asset transactions exceeding AED 3,500 require full originator and beneficiary details. STRs must be submitted immediately and tipping-off remains criminalized.

Practical Implications

For companies, DNFBPs, VASPs, financial institutions, and commercial gaming operators, compliance now requires tangible action: Update Enterprise-Wide Risk Assessments (EWRA) to include PF oversight; Revise AML-CFT-CPF policies and procedures to reflect new obligations; Expand CDD measures to incorporate PF risk monitoring; Update customer risk assessment methodologies; Broaden Compliance Officer responsibilities to cover PF and VASP oversight; Identify nominal managers/shareholders for UBO purposes; Implement training programs on updated policies and procedures.

For companies and regulated entities operating in the UAE, this means revisiting internal controls, customer due diligence procedures, and ongoing monitoring frameworks to ensure alignment with the New AML Law. Businesses should also anticipate heightened supervisory activity and be prepared to respond swiftly to any FIU directives, information requests, or asset freezing orders.

For companies navigating high-value sectors, including financial services, gaming, and virtual assets, adherence to these enhanced standards is imperative. In doing so, the UAE positions itself as a global leader in anti-money laundering and counter-financing frameworks, setting a benchmark for innovation, accountability, and international best practices. Ultimately, these reforms reinforce the nation’s ambition to continue to be a trusted, resilient hub for commerce, finance, and investment on the world stage.

Written by

Ibtissem Lassoued

Partner, Head of Compliance, Investigations & International Cooperation

Next Article

Written by

Ibtissem Lassoued

Partner, Head of Compliance, Investigations & International Cooperation