- Arbitration

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Compliance, Investigations & International Cooperation

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

Find a Lawyer

Book an appointment with us, or search the directory to find the right lawyer for you directly through the app.

Find out more

The Technology Issue

Decoding the future of law

This Technology Issue explores how digital transformation is reshaping legal frameworks across the region. From AI and data governance to IP, cybersecurity, and sector-specific innovation, our lawyers examine the fast-evolving regulatory landscape and its impact on businesses today.

Introduced by David Yates, Partner and Head of Technology, this edition offers concise insights to help you navigate an increasingly digital era.

2025 is set to be a game-changer for the MENA region, with legal and regulatory shifts from 2024 continuing to reshape its economic landscape. Saudi Arabia, the UAE, Egypt, Iraq, Qatar, and Bahrain are all implementing groundbreaking reforms in sustainable financing, investment laws, labor regulations, and dispute resolution. As the region positions itself for deeper global integration, businesses must adapt to a rapidly evolving legal environment.

Our Eyes on 2025 publication provides essential insights and practical guidance on the key legal updates shaping the year ahead—equipping you with the knowledge to stay ahead in this dynamic market.

The leading law firm in the Middle East & North Africa region.

A complete spectrum of legal services across jurisdictions in the Middle East & North Africa.

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Compliance, Investigations & International Cooperation

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

-

Sectors

-

Country Groups

-

Client Solutions

Today's news and tomorrow's trends from around the region.

17 offices across the Middle East & North Africa.

Our Services

Back

Back

-

Practices

- All Practices

- Banking & Finance

- Capital Markets

- Commercial

- Competition

- Compliance, Investigations & International Cooperation

- Construction & Infrastructure

- Corporate / Mergers & Acquisitions

- Corporate Services

- Corporate Structuring

- Digital & Data

- Dispute Resolution

- Employment & Incentives

- Family Business & Private Wealth

- Innovation, Patents & Industrial Property (3IP)

- Insurance

- Intellectual Property

- Legislative Drafting

- Private Client Services

- Private Equity

- Private Notary

- Projects

- Real Estate

- Regulatory

- Tax

- Turnaround, Restructuring & Insolvency

-

Sectors

-

Country Groups

-

Client Solutions

UAE’s Anti-Money Laundering Framework: A New Era for the Emirates Under Cabinet Resolution No. 134 of 2025

7 min 31 sec

January 19, 2026 (Edited)

7 min 31 sec

January 19, 2026 (Edited)

⚠️ Watch Out and Be Ready for an important regulatory change effective 14 December 2025

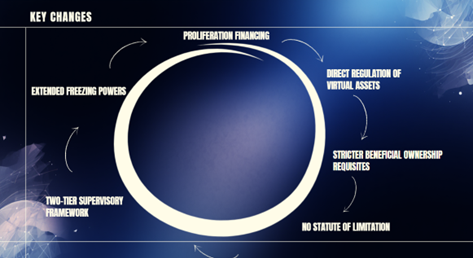

The Cabinet Resolution No. 134 of 2025 (the “Resolution”) came into force on 14 December 2025, replacing the previous Cabinet Resolution No. 10 of 2019. This Resolution implements the executive regulations of Federal Decree-Law No. 10 of 2025, issued earlier this year on 30 September 2025, and governs Anti-Money Laundering (AML), Combating the Financing of Terrorism (CFT), and Countering the Financing of Proliferation (CPF). The Decree-Law established the compliance framework, and Resolution No. 134 of 2025 turns that framework into practical, enforceable rules that guide day-to-day operations for businesses and companies.

Comprising 71 articles and nearly 300 enforceable requirements, the Resolution translates high-level policy into concrete, actionable standards. It establishes the UAE’s most comprehensive and operationally detailed anti-money laundering, counter-terrorist financing, and counter-proliferation framework to date, providing clear, measurable expectations for all Regulated Entities, including financial institutions, Designated Non-Financial Businesses and Professions (DNFBPs), and Virtual Asset Service Providers (VASPs).

The UAE has moved to bring its domestic financial crime framework closer to international norms, following FATF guidance and UN Security Council Resolutions on proliferation financing.

The recently issued Resolution No. 134 sets out clear obligations for identifying and mitigating proliferation financing risks and places VASPs on the same compliance footing as traditional financial institutions.

Proliferation Financing as the Third Pillar

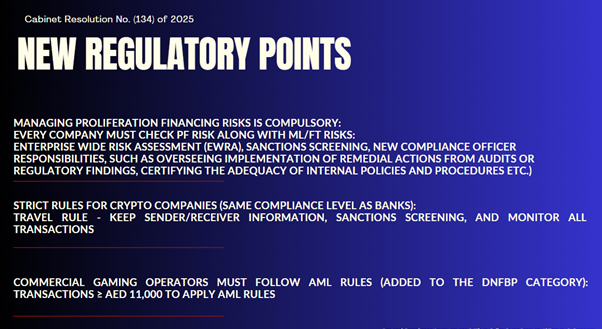

The UAE is raising the stakes for financial compliance. Proliferation Financing, long treated as a side issue, is now officially on par with Anti-Money Laundering and Counter-Terrorist Financing under the country’s revamped financial crime framework. The Resolution now requires banks, financial institutions, virtual asset providers, and other regulated entities to spot, assess, and curb PF risks across their entire operations. The move marks a clear departure from past practice, where PF risks were often buried within broader AML programs. Under the new rules, entities must integrate PF oversight into enterprise-wide risk assessments (EWRA), customer due diligence, and transaction monitoring.

Commercial Gaming Operators: The Cash-Heavy Sector Under Scrutiny

For the first time, commercial gaming operators covering casinos, online gaming platforms, and e-sports operators are formally recognized as Designated Non-Financial Businesses and Professions (DNFBPs) under the UAE AML-CFT-CPF regime. The following definitions in the 2025 Resolution have been introduced to reflect the enhanced scope of the law and improve transparency goals, such as:

- Commercial Games

- Commercial Gaming Operators

- Nominal Shareholder

- Nominal Manager

The reporting threshold for online transactions has been set at AED 11,000, whether in a single transaction or cumulatively across linked transactions. Senior management is expected to personally approve internal policies and oversee high-risk relationships, particularly those involving proliferation financing risks. The rationale is clear: emerging industries with significant cash flows must be transparent, accountable, and fully integrated into the UAE’s financial crime prevention ecosystem. For compliance teams, this means building tailored controls for e-gaming transactions, continuous monitoring of players, and verifying the source of funds, tasks that may have been peripheral before but are now central to the risk-based approach mandated by the Resolution.

The new reporting and oversight requirements take on particular significance in the casino and gaming sectors, where high-value transactions and complex customer activity can obscure illicit flows. For operators, this means more than just compliance on paper. It implies that ongoing monitoring, source-of-funds verification, and risk-based controls have become central to ensuring transparency and safeguarding the integrity of an industry increasingly under regulatory scrutiny. This becomes especially relevant considering how federal authorities in the UAE are expanding plans around casinos, lotteries, and other gaming activities. The federal General Commercial Gaming Regulatory Authority (GCGRA) now oversees the licensing and regulation of commercial gaming and national lottery operations across the Emirates, and the UAE Lottery has been established as the first federally licensed lottery under this framework.

This reflects a concerted effort to formalise and expand gaming offerings in a controlled and responsible way. In parallel, significant projects such as the Wynn Al Marjan Island resort in Ras Al Khaimah, planned to open in 2027, are positioning the UAE to host its first legal casino and integrated entertainment destination, attracting global operators and supporting the broader economic diversification strategy. These developments underscore the UAE’s evolving approach to gaming and leisure within a strictly regulated environment.

Virtual Asset Service Providers: Bridging Digital and Traditional Finance

VASPs are now fully aligned with conventional financial institutions in their AML-CFT-CPF obligations. They must adhere to the Travel Rule, ensuring virtual asset transfers carry full information on both senders and receivers. Screening for sanctions and PF risks must be continuous, and record-keeping obligations extend to at least five years. VASPs are further prohibited from facilitating transactions that obscure the origin of funds or the identity of beneficial owners. For executives and compliance teams, operational requirements are substantial: real-time monitoring, governance oversight, and structured reporting mechanisms are now mandatory.

Lowered Threshold for Principal Offences

A key feature of the Resolution is the lowering of the threshold for establishing liability for Principal Offences as defined under the Resolution. The term “Principal Offences” encompasses underlying predicate offences, including any act that constitutes a felony or a misdemeanor under applicable statutes, whether committed inside or outside the State and punishable in both jurisdictions, that form the basis for associated financial crime liabilities such as money laundering, terrorist financing, or proliferation financing. Previously, liability depended on actual knowledge of illicit funds, a subjective standard that often-limited enforcement. The revised framework allows knowledge to be inferred objectively, a person may now be held liable if they either knew or should reasonably have known that funds were illicit.

New Offence: Misuse of Accounts

The Resolution also rolls out a new offence targeting the misuse of accounts in financial institutions or VASPs. Individuals who allow third parties to exploit such accounts, whether knowingly or where circumstances objectively suggest intent, are now criminally liable. This closes a prior enforcement gap and reinforces the duty of vigilance across all accounts and client interactions.

UAE Courts and Enforcement of Foreign Orders

Courts in the UAE are now authorized to enforce foreign judicial orders, including provisional measures and the confiscation of criminal assets, without conducting a separate local investigation. Legal experts say the change aligns the UAE with international norms and closes a gap that had previously complicated cross-border enforcement.

The reform is expected to streamline efforts by foreign authorities seeking to recover assets tied to financial crimes, corruption, or other criminal activities within the Emirates. By making foreign rulings directly actionable, the UAE is showing its commitment to a more integrated global legal framework, a move that could have far-reaching implications for multinational businesses and international investors operating in the region.

Governance, Risk Management, and Compliance: Personal Accountability

Senior management now bears explicit personal responsibility for compliance across all AML-CFT-CPF pillars. Executives must approve internal policies, oversee high-risk clients, and monitor program implementation. Enhanced beneficial ownership identification, including 25% ownership thresholds and fallback to senior officials, eliminates ambiguity and strengthens transparency.

Transaction Monitoring and Record-Keeping: Continuous Oversight

Transaction monitoring is now continuous, exhaustive, and enforceable. Wire transfers and virtual asset transactions exceeding AED 3,500 require full originator and beneficiary details. STRs must be submitted immediately and tipping-off remains criminalized. Article 25(2) maintains a statutory minimum record-retention minimum period of five years, however, as per the new law, the interesting caveat is that this period runs from the most recent of several prescribed trigger events, including relationship termination, account closure, completion of supervisory inspections, investigations, or final judicial judgment. As a result of these cascading triggers, the practical effect of the provision is that records are routinely required to be retained for five years or even more in in investigative cases or wire-transfer matters, and capable of extending further where supervisory or judicial processes intervene, while beneficial ownership and transaction records must remain updated within 15 working days of any change.

What Must UAE Businesses Do to Comply with the Updated AML Framework?

For companies, DNFBPs, VASPs, financial institutions, and commercial gaming operators, compliance now requires tangible action:

- Update Enterprise-Wide Risk Assessments (EWRA) to include PF oversight

- Revise AML-CFT-CPF policies and procedures to reflect new obligations

- Expand CDD measures to incorporate PF risk monitoring

- Update customer risk assessment methodologies

- Broaden Compliance Officer responsibilities to cover PF and VASP oversight

- Identify nominal managers/shareholders for UBO purposes

- Implement training programs on updated policies and procedures

These measures are essential to ensure compliance with Cabinet Resolution No. 134 of 2025 and Federal Decree Law No. 10 of 2025, and to maintain operational integrity in an increasingly complex regulatory environment. By incorporating rigorous controls, real-time monitoring, and a culture of transparency, UAE businesses can mitigate financial crime risks while instilling investor confidence, which is already on a rise. For companies navigating high-value sectors, including financial services, gaming, and virtual assets, adherence to these enhanced standards is imperative. In doing so, the UAE positions itself as a global leader in anti-money laundering and counter-financing frameworks, setting a benchmark for innovation, accountability, and international best practices. Ultimately, these reforms reinforce the nation’s ambition to continue to be a trusted, resilient hub for commerce, finance, and investment on the world stage.

Note: The Arabic version of this Client Alert is available upon request.

Written by

Ibtissem Lassoued

Partner, Head of Compliance, Investigations & International Cooperation

Next Article

Written by

Ibtissem Lassoued

Partner, Head of Compliance, Investigations & International Cooperation